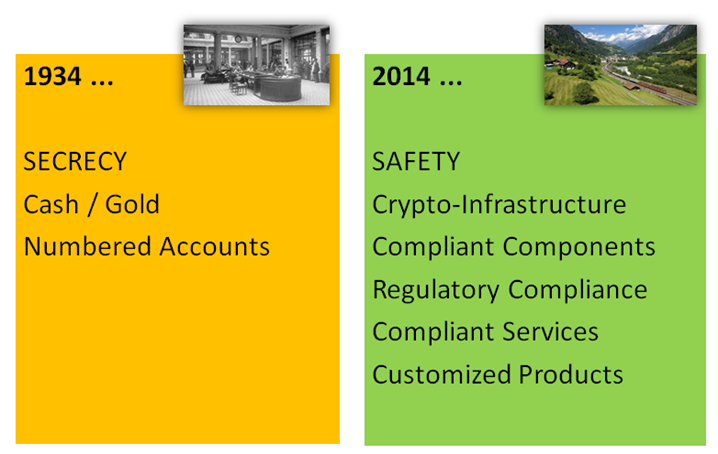

As global financial centres such as Switzerland grapple with the need to reinvent their business model, Shift Thought recommends a way forward that will enhance rather than challenge reputational branding.

A Big Thank You from the team at Shift Thought

A big thank-you for the huge interest and support for our webinar Digital Money: a new business model for Switzerland. We also take this opportunity to thank the UK Trade & Investment for this opportunity, and in particular Anna Faber, Commercial Officer - Technology & Innovation, who was a source of inspiration and support, and without whom this would not have been possible.

The recording is now available at this link

On the webinar we reveal our thoughts on an architecture that could form the basis of a new business model to innovate in the context of cryptocurrencies. Some of the questions we addressed within this recording are:

- Do we see similar challenges in implementing Bitcoin, as encountered for the Euro?

- Which type of digital money has the greatest potential for the future?

- Do you think digital money should be regulated? Is this possible? How?

- What do you view as the biggest problems with Bitcoin: technical such as the ability to scale, regulatory such as government reactions or business model fit?

- Would you agree that ultimately only one cryptocurrency will exist?

- Are some banks more ahead of the game than others when it comes to digital money?

- Do you see a service like PayPal as being threatened by Bitcoin or enhanced by it?

- What would be the first step for a "traditional" Swiss private bank to take an interest in Bitcoin & cryptocurrencies?

- Are some banks ahead of the game more than others when it comes to digital money ?

Our next blog offers further answers to some of the questions covered on the webinar. We also received a number of follow-up questions and these will be answered in depth by Dr. Neeraj Oak. We invite you to participate with us as we explore the development of this critically important topic. It would be great to make this a dialogue in which people from around the world can join.

We have therefore created the Digital Money group on LinkedIn

Please join this group today, to add your unique perspective to the body of knowledge being created. This group brings together news and views on how digital money is changing the way people pay around the world.