In my last blog I identified a couple of building blocks necessary when discussing “who will win the digital money game”. In this blog I will establish the first, which is a working definition of digital money.

There are probably as many definitions of digital money as there are people defining it, but most definitions can be classified according to the perspective used by the person providing the definition. Our research in Shift Thought shows that there are four major perspectives, the interface perspective, the characteristics perspective, the operations perspective and the ecosystem perspective.

Each of these are of course valid, but are neither consistent nor complete in themselves. We therefore take all of these into account to develop a working definition for digital money.

So lets talk about each of these in a little more detail

The interface perspective

This is the perspective that consumers adopt when they think of digital money. When you ask a consumer what they think digital money is, they will usually point to their preferred payment instrument or method as an example (other than cash, of course!).

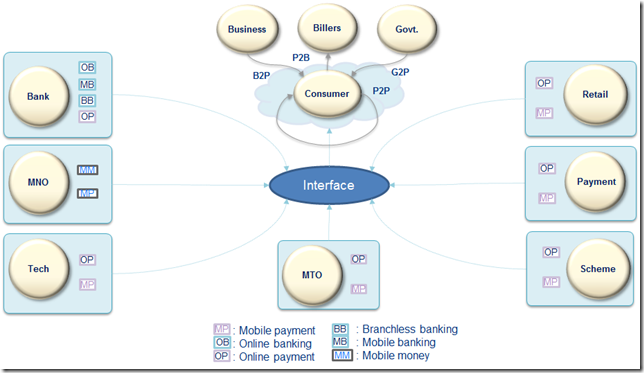

Look at the diagram below. It communicates the idea that consumers access multiple payment services, provided by different providers in different contexts through an interface when transacting with businesses, billers, the government and other consumers in the “cloud”.

The focus of the consumer is on completing the transaction through the chosen interface (or instrument) with the other party, they will only be peripherally aware of the nature and name of the service used, and the number and types of players that are involved in its delivery.

What then is the interface? It could be anything that the consumer recognizes, including credit and debit cards, mobile phones, digital wallets, a page in a web-browser … the list is increasing all the time.

Clearly this is a valid but far from complete perspective. It ignores everything in the picture other than the payment instrument or interface. Also it tends to a view that everything non-cash must be digital ( what about cheques then? )

The characteristics perspective

In this perspective we are still talking about the interface, but with an eye on its characteristics. Digital Money is seen to be a cash-replacement but one which is capable of conferring many benefits and advantages to both sides of the transaction, that cash simply cannot. The “digital” bit then refers to the intervening services / technologies that makes it possible, the focus is on the “money”. This perspective therefore looks at digital money as a progressive continuum away from cash and in the direction of added desirability.

So what are the characteristics and the benefits that make a particular instrument / interface / service combination more desirable? Take a look at the diagram below. It communicates those characteristics that Shift Thought uses to assess the desirability of a particular combination and the benefits that it should create on either side of the transaction i.e. for both consumers and merchants.

In terms of characteristics

- ubiquitous implies that the service should be available any-time and any-place

- proximal implies that access to it should be close and easy (just reach for your wallet / mobile ?)

- unifying implies that it should hide the underlying complexity and present a unified interface even if multiple services and providers are involved

- unobtrusive implies that it should not in itself be the focus, only the means of completing the consumer’s transaction

- contextual implies that it should be both active and smart in understanding the context of the transaction and offering the right choices, not passive like cash

- homogenous implies that it should favor uniformity rather than any particular configuration of services or interfaces

In terms of benefits, Shift Thought has developed the concept of the 7C’s

- certain refers to the confidence that the user can have that the transaction will complete, i.e. the perceived risk of using that service or interface

- cheaper naturally refers to the idea that the cost of the transaction would be lower, ( and the transaction may itself only be possible ) using digital money

- cash-like refers more to its status as a recognized currency, and to an extent the anonymity afforded by cash

- clever refers to its ability to actively choose or assist in the choice of the most appropriate instrument / service for a particular transaction

- contextual refers to the idea that digital money should be embedded seamlessly in the context of the transaction and not require the user to leave the context (you should not have to leave your shopping cart to go elsewhere to pay for it)

- convergent refers to the idea that multiple services should converge on the device that the user chooses, be it a card or a mobile phone, rather than a separate device for each

- collaborative refers to the idea that the underlying services should collaborate in fulfilling the transaction, enabling the user to choose the best configuration, rather than one from many exclusive services

The first three benefits are qualifying ( you wouldn’t use digital money without those ) while the remainder reflect increased desirability.

Both the perspectives discussed so far constitute an outside-in view of digital money. They concentrate on what it looks like rather than what it contains and how it works, which is the focus of the following perspectives.

The operations perspective

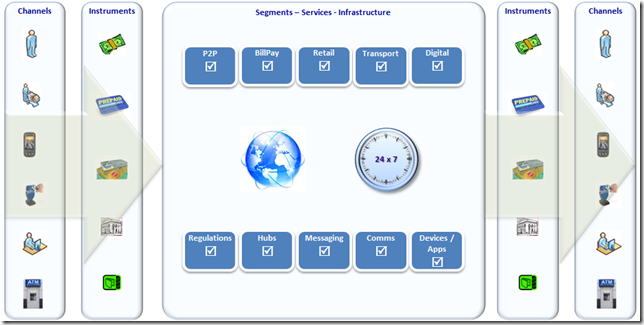

The operations perspective focuses on how digital money transactions are fulfilled, i.e. the anatomy of digital money services. Shift Thought have devised a conceptual framework based upon the conventional value chain in a two-sided market, as shown in the figure below.

As the figure shows, transactions can occur through multiple channels using multiple instruments, across many segments and infrastructures. A single service may support multiple channels, instruments and segments, and a player may support multiple services. Again services may be local regional or global and available in a time window or round the clock.

This perspective is valuable to those who must operationalize the service, assess its performance or externally source specific components towards its delivery. While this perspective provides a much more detailed understanding of a specific service or a configuration of services, it ignores the rest of the digital money space as a whole, where the presence of other services, providers, and segments can have a significant impact on the competitiveness and sustainability of a given service.

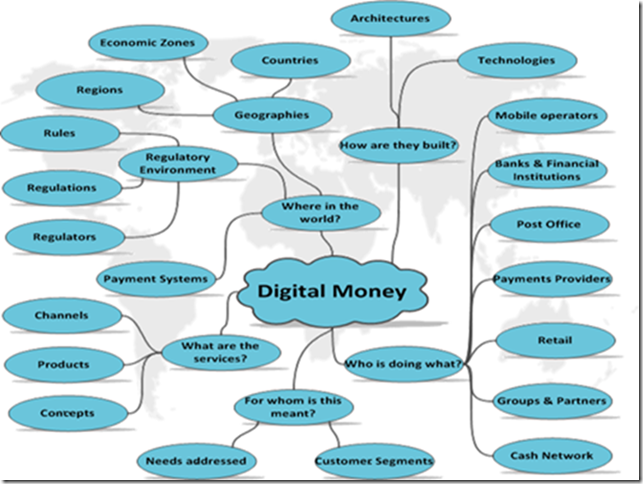

The ecosystem perspective

This perspective recognizes that digital money is actually a very complex ecosystem with many and varied constituents and relationships which are both growing and changing rapidly and concentrates on understanding and tracking the nature of those constituents and their relationships, and monitoring their evolution. This is captured in the diagram below.

This perspective, which is the subject of the Digital Money SAGE, is of value to investors, strategists, marketers and service designers who need to assess the market, the competition, the availability and state of services and infrastructures and the regulatory environments when making informed decisions.

A working definition of digital money

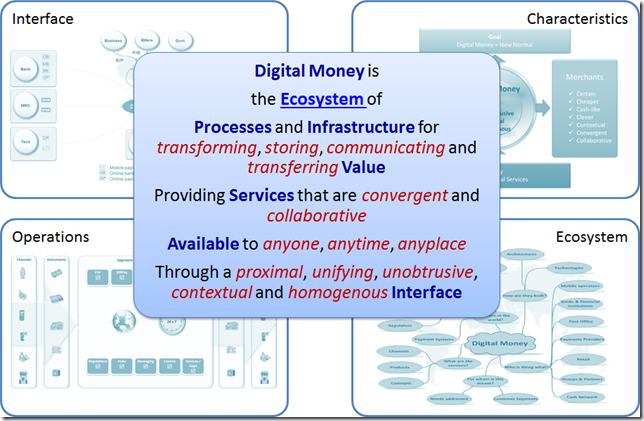

As we have seen earlier, every perspective is both necessary and insufficient. Therefore a sufficient definition of digital money should not merely incorporate the interests of each perspective but integrate these in a coherent way.

Shift Thought has created a definition that captures the four perspectives discussed earlier in the figure below

The influence of the individual perspectives is evident in the definition. The integrating element in the definition is the inclusion of the phrase “transforming, storing, communicating and transferring value”. The effect of this is to lead to the inclusion of infrastructures and processes which might not seem directly relevant to digital money at first glance ( e.g. messaging, security, regulatory compliance etc. )

The comprehensive nature of this definition is vital. The importance of this will become evident when we discuss the characteristics of the likely winners of the digital money game. A holistic view of digital money is critical in managing the user’s context, which is what winners do well. But more of this in future blogs.

With a working definition of digital money at hand, we now need a framework to understand how the game is played. In the next blog we will look at the conventional value chain framework and identify its limitations and then look at an alternative, virtual value chain approach that better describes the game. We will consider a few well known examples to illustrate the principles.

I hope to see you again in the next blog!

Pingback: Shift Thought | Digital Money | Dutch retail payment costs EUR 1 billion less per year than European average | Digital Money

Pingback: Digital Money | Mobile Money in China – a classic example of Digital Money | Digital Money

Pingback: Digital Money | Q&A from our “Disruptions in Digital Payments in China” webinar | Digital Money

Pingback: Digital Money | Bitcoin – Fan it or Ban it? | Digital Money

Pingback: Bitcoin – a payment disruptor | The Karena Arena

Pingback: Digital Money | Digital Money: A new business model for Switzerland | Digital Money