Shift Thought recently completed a set of interviews where we spoke to experts from a range of industries and parts of the world to get their gut reactions on the state of the payments industry and what to expect next.

In this post I share highlights of my discussion with Roy Vella, Digital Services Evangelist and Entrepreneur with a rich experience across a wide range of organizations in EMEA and the U.S. Roy reflects on what for him were some highlights of 2014 and shares his thoughts on what to expect this year.

Roy, thanks for your time today. I would like to start by asking what, for you has been the most innovative service you’ve seen over the last year, at the intersection of mobile/ online and financial services?

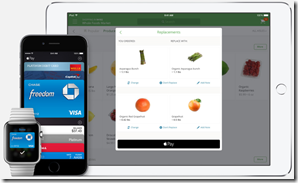

For me, Apple Pay has been the most significant. Once again, they did what they do so well. They take something messy and refine it. Just as they did with iPods/iTunes and the iPhone, they’ve created a great customer experience by making a few key changes. Apple tends to be able to take things off the shelf but then simplify and get the experience right.

For me, Apple Pay has been the most significant. Once again, they did what they do so well. They take something messy and refine it. Just as they did with iPods/iTunes and the iPhone, they’ve created a great customer experience by making a few key changes. Apple tends to be able to take things off the shelf but then simplify and get the experience right.

When they launched the first iPhone, arguably they did it with what could already be bought off the rack in China. It’s not what they deliver but rather how they put it all together, to make it simple, intuitive and delightful. That is the innovation! It is not making something radically new but it’s making something truly simple.

But in order to make it simple, they’ve managed to bring together a lot of different technologies for the first time, to allow a simple “press the button” experience.

True, they had to bring together Passbook, Touch ID, NFC capabilities, encryption, tokenisation and more. Apple is probably going to kill the business proposition of a lot of providers accidentally, even though they don’t actually care about payments. All they care about is bringing together those three things that you, I and everyone need before we leave home: your keys, your wallet and your phone.

Apple simply wants to put it all together. They want to get rid of your wallet. And they’re making progress on this with Apply Pay, the Apple Watch, with their work on access to hotel rooms and security. I’m sure they’re talking to major hotel groups, luxury car manufacturers and others, to make big changes in how people gain access to all sorts of places and things.

What are the pain points that providers encounter when they try to bring out Payments Innovations?

What they find difficult is what Apple does so well. It’s essentially the battle of getting people to adopt something new. That is what Apple is good at – changing consumer behaviour, getting people to change the normal way that they do things.

For any infrastructure play the most difficult thing is that most people don’t want change. And innovation is hard because key stakeholders, regulators and others also often don’t like change.

Actually people often talk about achieving “mainstream adoption” but that’s not what concerns Apple. They want those premium customers. That is their segment. The top 15-20% max really.

But if Apple is solving for the 15-20% premium customers, who is solving for the rest?

Before Apple Pay we had similar solutions on the Android, 9 months to a year earlier! Google, Samsung, PayPal and others offered quite similar services as Apple Pay. But did anyone take notice? We did not see them move the needle – then Apple announces and boom, consumers sit up and we have change.

Who for you are the winners of 2014? Which categories of players impressed the most?

I don’t think mobile operators as an industry were able to do that much. Sure, we’ve heard of various partnerships between banks and operators or other categories. However it was not ground breaking innovations. I believe that both banks and mobile operators have taken a back seat to the big tech services, GAFA, at this point. And they’re all innovating rapidly.

The other group that’s made significant progress over 2014 is the regulators. They’re no longer spending all their time protecting the incumbents. They want more competition, entrepreneurs and a better deal for consumers. This is playing out across the US and Europe, and also worldwide.

Talking about regulations, what’s your opinion of Bitcoin?

I feel that Bitcoin tends to be misunderstood. It is a currency of sorts but more importantly a protocol, the blockchain, but often people are fixated on the first and don’t quite get the second. Reliably moving value between parties, without a middleman, is a brilliant innovation. It is not all about money. It could be any object of value or ownership – it could be a birth certificate or a lease, for example.

No matter what anyone may think, cryptocurrencies are here to stay. It’s impossible to stop them. Saying that you don’t like bitcoin or the blockchain and it should be stopped is like saying your don’t like SMTP or HTTP… it’s merely a technical protocol for value transfer that now exists and won’t simply evaporate as such, even if regulators attempt to quash it.

Yes, banks have not made it easier, with their massive FX scandals and other issues. Do you see this pushing people further toward P2P and innovative new entrants?

Absolutely! Take the example of Transferwise. I think they’ve done a brilliant job shining a light on fees and making things more transparent. Ultimately consumers care about how much they pay and what their receivers get in terms of currency. Transferwise states that in terms of what you put in and how much you get out it’s hard to get a comparable rate. Significantly, Transferwise has gotten their marketing and message right… it resonates with people.

Roy, from your experience at PayPal, it would be good to hear what you think about the PayPal/eBay separation – how’s that going to work out?

We were talking about this way back in 2004. It is something that had to happen, but back then they needed each other tremendously. However staying together is holding them both back now. I know they will be better apart. It’s going to be good for PayPal, sure, but it’s also going to benefit eBay. I think individually they could each have the same valuation as they have together.

You talk about the digital wave and how that is subsuming things - What really changed over 2014 thanks to mobile?

I think 2014 has been all about smartphones achieving deep, mass penetration. This is not just in developed countries but also in the high-growth emerging ones.

What do you foresee for 2015? What’s most exciting?

I think the chip is going into everything. Having all these devices become smart, there is an early adopter phase that is quite exciting. It is not all about payments. Payments must be transparent, just an enabler and it must make everything simpler for consumers and merchants.

Thanks Roy, it’s been a pleasure speaking with you. Wish you the best for 2015 and beyond!

|

Roy Vella is Managing Director of Vella Ventures Ltd where he offers strategic advice as an expert in the Fintech industry. Roy is special Advisor to MEF and on the board of several companies. Notable clients include Visa, Vodafone and Lloyds. Previously Roy was Group Executive, Director of Mobile Financial Services for the Royal Bank of Scotland Group. Roy also has rich experience from his work at PayPal Europe as Director, Mobile Payments for Europe and in Business Development for PayPal Inc. See more at linkedin.com/in/royvella. |