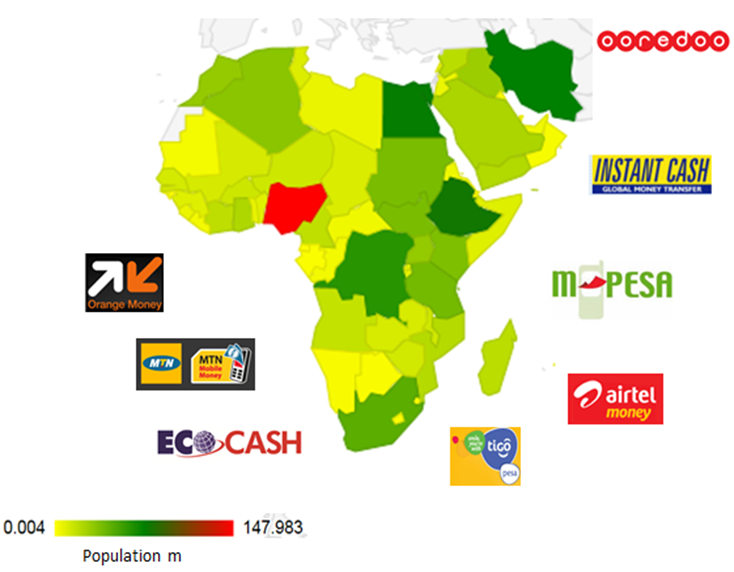

Pyramids have fascinated civilizations for centuries, with the Great Pyramid of Khufu in Egypt today remaining the only one of the Seven Wonders of the Ancient World. While the Egyptian pyramids are most famous, Nigeria, Greece, Spain, India, China, Indonesia and even Europe and the Americas have their share. The unique design and the sheer weight of the stone ensures that the structures do not topple, and there is no question of material at the bottom ever getting displaced. Now in these and other countries mobile financial services are taking off, to address financial inclusion. I was fascinated by C. K. Prahalad’s book “The Fortune at the bottom of the Pyramid” which has been an inspiration to me over the last decade I’ve spent as a practitioner in mobile financial services.

Carol Realini’s work at Obopay has also been inspirational to me, as I had an early opportunity to meet her and follow her achievements in the US, Africa and India. I was therefore delighted when Carol shared with me about the book she and Karl Mehta were writing, “Financial Inclusion at the bottom of the pyramid”. Naturally I wanted to share her story, below – Enjoy!

Carol, great to have you here today, please could you share with us a bit about what motivated you to write this book, and what you hope to achieve?

My interest in Financial Inclusion started in 2002 while travelling in Africa after a company I founded had a successful public offering.

My eyes were opened to—

- The wonderful entrepreneurial spirit that exists throughout developing countries

- The lack of infrastructure for participating in global online commerce

- The lack of infrastructure for making day-to-day living easy. Locals were standing in line all day to just pay their utility bill and small businesses were confined to operating on a cash basis with their customers and suppliers.

- The absolute inability of entrepreneurs to scale and grow their businesses.

I became focused on fostering entrepreneurship and the development of new technologies that would empower everyone’s life and work.

The epiphany—

I had never really thought about life without access to affordable financials services. Mobile phones were everywhere and now exceed the world’s population. I realized this could be a game changer for financial services, creating a very different future for all of us. After witnessing the overwhelming poverty and unwieldy payment systems, I knew that mobile banking would be the key to altering how people exchange money, and in turn, create access to financial services where none had ever existed.

To whom do you feel this book will be most useful and why?

Our book primarily targets two audiences: Firstly the FinTech community, as the mobile phone is a key enabler for innovation. Secondly, really I would love for it to reach all people interested in how the world could change for the better. We hope that our book entertains and informs both audiences. It delves deep enough to share new insights with the FinTech community, yet effectively explains the financial services landscape to those who are ready to learn and be inspired. So far reviews have been very positive from both groups. Having been exposed to real-life case studies that are changing the face of financial services, readers from all over are inspired by the global shift that lies in front of us.

You are yourself one of the pioneers, can you share a bit about your story?

I have founded two companies within the Financial Inclusion sector and I am an active board member for several other companies working in mobility and “mass-market fintech.” My co-author, Karl Mehta founded a global payments company which was later sold to Visa. Throughout that transition he was key mobility executive and now is an active Venture Capitalist and Founder/CEO of EdCast— a disruptive approach to higher education.

I have founded two companies within the Financial Inclusion sector and I am an active board member for several other companies working in mobility and “mass-market fintech.” My co-author, Karl Mehta founded a global payments company which was later sold to Visa. Throughout that transition he was key mobility executive and now is an active Venture Capitalist and Founder/CEO of EdCast— a disruptive approach to higher education.

My first company, Obopay was a pioneer in Financial Inclusion and is currently one of the leading providers of mobile money in East Africa. We were early to enter the market and saw first hand the challenges when the infrastructure for identity, settlement, and communications was immature.

Mobile phones are now a mainstay all over the world and many countries in Asia and Africa have sorted out regulations to handle incoming technologies. Smart phones are also scaling very fast, creating more space for innovation.

Once the technological and regulatory landscape was primed, my second company (a US-based faster payments company) scaled quickly and was acquired in under 2 years. I am now on the board of 5 companies all working in this space and help others wherever possible.

In a nutshell, what do we need to get right, for financial inclusion @ BoP to become a reality?

Regulations and infrastructure are key to massive change. Institutional banks and investors also need to embrace innovation. Opening our eyes to including innovation from unexpected places will create more opportunity (for instance, Telcos have become the last mile to the customer for banking). Finally, considering new players in the space with disruptive models can bring a new perspective, and sometimes, a better solution to a problem.

At the end of the day, the financial needs of those at the BoP will not match those who use traditional banking. We need to create products and services that are relevant to each customer and their lifestyle. These will look and behave differently across countries, states, towns, and villages.

We hope our book helps to open the reader’s eyes to what is possible, what is currently working, and where there is opportunity for change. It proves that solutions DO exist—they are just not evenly distributed.

You give a call to action at the end of your book, could you share a bit about this?

If you are inspired to change the world, it is easy to get involved. You don’t have to quit your day job or be a “mover and shaker” within the FinTech community. If every reader made one small shift in their lives to support financial inclusion (start a group, show a preference for companies who are committed to financial inclusion, or join the conversation @SuccessatBOP), we’ll be well on our way to a better place for all.

I have found that once readers realize they already have a voice, they become inspired to create change, whether by one simple action or through massive effort. Either way, I think the book shows how important these initiatives can be. As Jeffrey D. Sachs, Director of the Earth Institute at Columbia University (and generous author of our Foreword) puts it: “The end of poverty is coming our way and this brilliant book explains how and why.”

Carol, Who are the unbanked and could you share about “Financial Nomads”, something I found very interesting when I read your book

Half the world are Financial Nomads. The world population is roughly seven billion. Of these, 4.6 billion are aged twenty or older. They comprise the pool of adults who could be regular customers of a financial services provider—a bank, savings and loan, credit union, or even Wal-Mart. Estimates suggest that of this eligible pool of 4.6 billion adults, over half—2.5 billion—do not use an established and reputable financial services provider. They are financial nomads who either have no access to financial services or use financial services on a casual basis when they need them.”

Apart from income, what are some of the other factors that have an impact on financial inclusion?

Gender, education levels, age, rural or urban life - all of these matter, but especially gender. In developing economies, forty-six percent of adult citizens have bank accounts, but only thirty-seven percent of women do—and this number includes joint accounts held by both husband and wife. In developing economies, this disparity exists at all income levels. In high-income economies, the difference is less and only approaches a four percent difference for poor women.”

Carol, how does this affect me, a middle class individual living in a developed country?

The lack of affordable and adaptable banking services is an issue that should concern everyone, not just the people who are living at the bottom of the pyramid. At its worst, a lack of banking creates a downward spiral of disenfranchisement, widens the gap between rich and poor, encourages outlaw or extralegal behaviour, and inhibits the social mobility that keeps any society vibrant and open. An accessible and reliable banking system helps to create stability and overall prosperity.

We have seen the costs to living at the bottom of the steep pyramid, and the obstacles that keep many hardworking individuals and families from making the long climb to the top. However, the goal of this book is not only to point out the challenges but to draw attention to the real-world solutions that exist today.

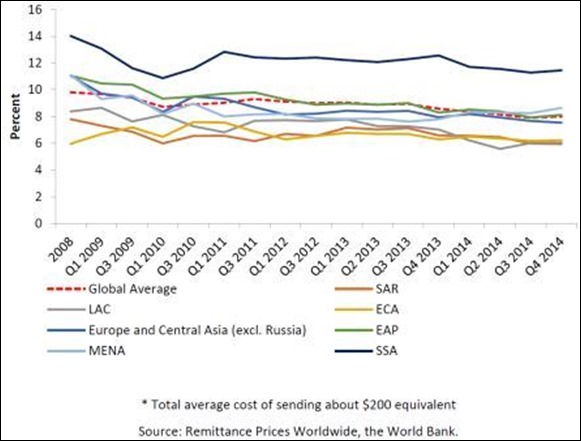

How far have we come so far in addressing this issue?

We’ll see that, in many cases, the future is already here; it’s just not equally distributed yet. Innovation is emerging as a patchwork. We’re entering a new era where the world will see a shift from incremental advances in financial inclusion to exponential growth. Part of the revolution in personal finance is driven by global social change: the growing empowerment of women, the rise of stable democratic governments, and the increased recognition of basic human rights. Technology is also a major force; the rise of the Smartphone, improvements in banking infrastructure, cloud computing, social networking, the management of vast amounts of real-time and archival data, mobile technology and networks, and the successful scaling of regional models to national and international scale - are all drivers of change.

Carol thanks so much for taking the time to address this important area and I wish you the very best for the success of your book and this key initiative

Carol Realini is co-author of “Financial Inclusion at the Bottom of the Pyramid”. An expert in financial service innovation, Carol Realini is a serial entrepreneur and globally-recognized technology pioneer. Attending the World Economic Forum, she led global discussions on alternative banking. Recognized as a top woman in Silicon Valley, she sits on boards and advises financial services and mobile companies.