World Bank’s recent reports on remittances indicate a welcome continued buoyancy. India remains the largest receiver, as growth in 2014 is led by East Asia and the Pacific, South Asia, Latin America and the Caribbean. However MENA flows are affected due to disturbances in the region, and ECA countries traditionally receiving inflows from Russia are badly affected. While mobile money has been adopted for domestic money transfer, 7 years on it has yet to make the inroads into cross-border remittances that was originally expected.

Good news as global cost of remittances falls from 8.9% to 7.9%

The global average cost of sending $200 fell from 8.9% in 2013 to 7.9% in Q3 of 2014, as remittances go online and digital. Account-based money transfer (cash-to-account is the lowest-cost method today). However although mobile money is being used for domestic money transfers, and is making an impact on sending money from urban to rural areas, its use for cross-border transactions remains limited. Less than 2% of remittance value took place through mobile phones. Yet with global remittance flows at $542 bn this even now represents a flow of $10 bn.

However Bill Gates believes that even with all the regulatory compliance it should be possible for pure digital to digital transactions to be moved at less than a percent. We are still far from achieving this goal. Is it a case of further enablers or something else that is needed to make this this possible?

Global remittance flows to developing countries are projected to reach US$435 billion in 2014

At a much welcome 5% increase over last year, the growth is expected to continue into 2015, though at a reduced rate of 4.4%. Total flows are expected to rise from US$582 billion in 2014 to US$608 billion in 2015.

Forced migration is at an all time high with 73 million forced to leave home

The main message from the latest World Bank report on migration is that forced migration due to conflict has reached the highest level since World War II. Of the 73 million who had to leave their homes, over 51 million were forced to move due to conflict, and 22 million moved due to natural disasters.

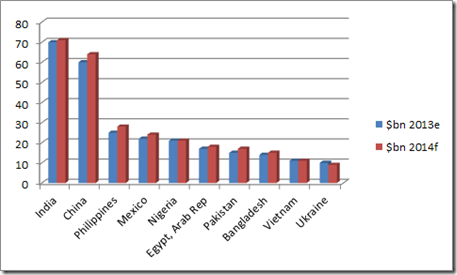

India remains largest recipient at estimated $71 billion

Highest receivers are India ($71 b), China ($64 b), the Philippines ($28 b), Mexico ($24 b), Nigeria ($21 b) and Egypt ($18 b). Yet these flows are not as high as they could be. The largest receiver, India, only receiver 3.7% of GDP in 2013.

Remittance flows respond to natural disasters

Remittances continue to offer a much-needed lifeline of support in times of natural disasters, rising by 16.6% for Pakistan in 2014, and 8.5% in the Philippines in 2013 in response to destruction from the super typhoon.

Regional trends

Remittances are projected to increase by 7% in the East Asia and Pacific region (EAP) with China and Philippines being the largest receivers. Remittances to South Asia have rebounded strongly in 2014, expected to grow by 5.5% to over $117 bn in 2014, with very strong growth for Pakistan, Nepal and Sri Lanka.

Growth in remittances to Sub-Saharan Africa is picking up in 2014, expected to reach $33 billion in 2014. Nigeria continues to dominate in terms of inward remittances flow, with $21.3 bn forecast for 2014.

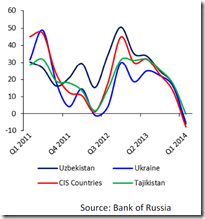

Remittances to Europe and Central Asia (ECA) are slowing as compared to 2013 affected by conflict in Ukraine and sanctions against Russia. The figure shows how receivers of remittances from Russia have been affected as remittances received continue to decelerate.

Remittances to Europe and Central Asia (ECA) are slowing as compared to 2013 affected by conflict in Ukraine and sanctions against Russia. The figure shows how receivers of remittances from Russia have been affected as remittances received continue to decelerate.

Another affected region is the Middle East and North Africa, but despite the volatility, remittances represent substantially larger and more stable sources of inflows. Remittances to the region are expected to grow by 2.9% to reach $51 bn. Remittances to Egypt are expected to stabilize in 2014, after the 2013 decline of 7.3% in remittances to Egypt (biggest receiver in the region, 6th worldwide).

For the full World Bank report click here: Migration and Development Brief 23

Charmaine Oak, Practice Lead, Digital Money

Author of The Digital Money Game, co-author Virtual Currencies – From Secrecy to Safety

http://www.linkedin.com/in/charmaineoak

=======