Part 3

In this third and final post on the topic of Ethereum, Dr. Neeraj Oak sums up his thoughts on this potentially ground-breaking decentralised contracting system and considers the issues and benefits he thinks should be highlighted before Ethereum is launched.

To summarize my view in the previous two posts, Ethereum is a good idea but one that is far more complicated than even Bitcoin was at its inception. This is an admirable thing, but it is important to provide credible solutions to the rather fundamental legal and technical issues that Ethereum faces before it is officially launched. Without these, Ethereum seems a risky proposition for any investor.

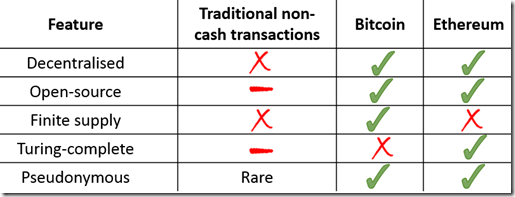

One vital part of creating a sound market proposition for Ethereum is in crafting a cohesive argument for why their service is better than a centralised, non-pseudonymous alternative. If the argument centres on the idea of a safe means of transferring data or value, then eliminating pseudonimity is a good way of achieving this. On the other hand, if the goal is to eliminate the need to trust a single central authority then this could be achieved in easier ways. For instance, making several independent organisations responsible for maintaining copies of the ledger would preserve a part of the checks-and-balances of full decentralisation without exposing ordinary users to the hassle and potential threats that could come from holding a copy of the ledger themselves. Without explicit reasons for including the design features of pseudonimity and decentralisation, Ethereum risks looking like a purely ideologically motivated experiment rather than a practical alternative for mainstream users.

It is also worth considering the merits and drawbacks of making the Ethereum project fully open source during development. While this certainly increases the confidence and engagement of the cryptocurrency community, it also makes it hard to keep competitors and clone services out of the market. Ethereum will live or die by its ability to get third party developers to utilise its smart contracts and scripting language. If Ethereum’s code can be easily reproduced, then it faces a real risk of being outcompeted by a cloned or forked service with a better marketing department. In response to this issue, supporters of Ethereum have made the argument in the past that the best guarantee of a quality service is the participation of its creators. I’m afraid I don’t subscribe to that view; the very fact that Ethereum is being developed a mere 6 years after the launch of Bitcoin suggests that open source projects are very susceptible to competition from new innovators from outside the immediate circle of their creators. More to the point, the effort of fighting off forks and clones will be a distraction to the Ethereum team, win or lose.

I’ll finish with this thought: the reasons why Bitcoin is the dominant cryptocurrency today is not only that it was first. It is also because it launched at a time when hardly anyone had heard of the concepts it espoused, and fewer still believed in them. Through its early years, it was obscure and barely capitalised. I believe that it was this period of insignificance that gave the Bitcoin community the time to find answers to its early critics in a relatively technical, low-stakes environment. In contrast, Ethereum will be launched with its coffers filled and in the full glare of the media spotlight. Its creators should prepare for a rocky few months after its launch.

Chief Analyst, Digital Money

Author of Virtual Currencies – From Secrecy to Safety, co-author The Digital Money Game

Join us to explore ideas at The Digital Money Group on LinkedIn

![clip_image00613[3] clip_image00613[3]](http://digitalmoney.shiftthought.com/files/2014/11/clip_image006133.png)

![clip_image00833[3] clip_image00833[3]](http://digitalmoney.shiftthought.com/files/2014/11/clip_image008333.jpg)

![clip_image01033[3] clip_image01033[3]](http://digitalmoney.shiftthought.com/files/2014/11/clip_image010333.png)