Blog 8

Dr. Neeraj Oak considers the size of Bitcoin and its scope for the future compared with other players and industries.

In this post, I will provide a context in which the size of Bitcoin, both present and future, can be judged. The true size of Bitcoin is often skewed in the media through qualitative descriptions; I will look at it quantitatively, and compare it with other relevant organisations and markets.

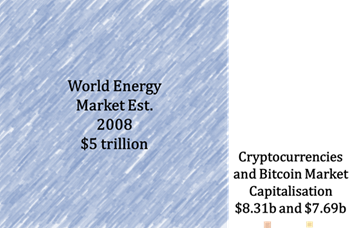

Let’s start with the cryptocurrency industry. I will show values as squares, with the area of the square proportional to its value.

Using market capitalisation as a proxy for size, we can see that Bitcoin forms very nearly the entirety of the cryptocurrency industry. Perhaps this isn’t surprising, given the earlier start and greater publicity Bitcoin enjoys over the other 670 alternative coins in more than 50 exchanges. Moreover, many of the other cryptocurrencies use Bitcoin as a basis of operation or an intermediary; thus the growth of these currencies will actually spur growth in Bitcoin.

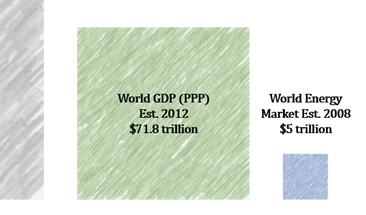

Let’s take a wider view. I’ve been asked about how cryptocurrencies could affect energy markets, as more computing time and energy goes into mining coins. The intrinsic link between the electricity used to mine a coin and its value was originally used to set the price of the first Bitcoin. It seems fitting to start by considering how Bitcoin compares to the world energy industry.

According to one estimate, the world energy market is worth around $5 trillion a year. Comparing this to cryptocurrencies by their market capitalisation isn’t a perfect analogy as they measure different things, but it’s enough to see that cryptocurrencies would have a very long way to go before they form a sufficiently large energy drain to cause any significant effects on the energy industry.

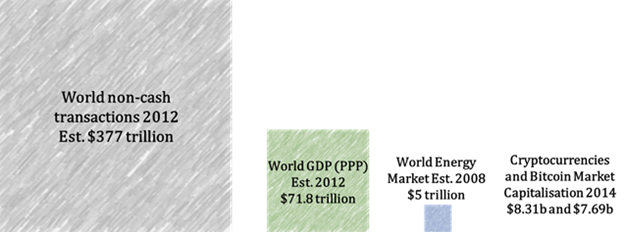

Beyond the energy industry, another great benchmark for size is the total size of the world economy. At this scale, the cryptocurrency squares are effectively invisible. But what’s that grey square on the left?

It turns out that the value of non-cash transactions made each year dwarfs even the global economy. This is the space which cryptocurrencies would wish to someday occupy- and it seems they have a fair way to go yet.

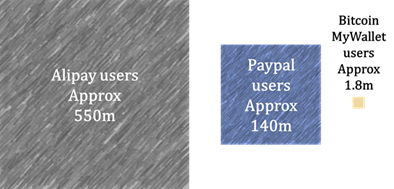

While we’re at it, let’s look at the number of users of Bitcoin in comparison to some of the other e-commerce services in the world.

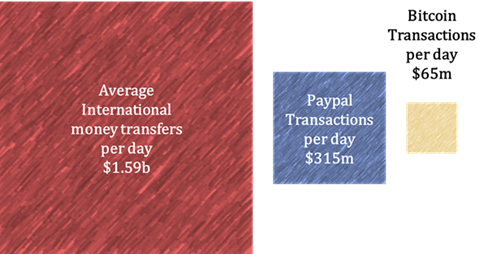

From this perspective, Bitcoin isn’t quite as miniscule, but is still far smaller than any of the big established players. It’s interesting to note that the transaction volume of Bitcoin per user is actually much higher than that of established services such as Paypal; it’s possible that this is a sign of trust from users, but to my mind it’s more likely that it is just an artefact of speculative trading and the decentralised structure of a peer-to-peer market. Over the past 30 days, Bitcoin has averaged a transaction volume of around $65m per day, whilst Paypal averages $315m.

Bitcoin also fares favourably against international money transfers (IMT) in terms of transaction volume. This is another prime area in which cryptocurrencies could be used to bypass existing institutions, especially in developing economies.

So what do all these comparisons tell us? It’s clear that Bitcoin is still in its infancy compared to some of the alternative payment methods, but this also means that there is a lot more room to grow. For now, Bitcoin is unlikely to cause any price effects in the energy industry, but that isn’t to say it could never happen; if Bitcoin were to process even 1% of world non-cash transactions, the energy drain from miners would be worth taking into consideration for energy policy planners. But that would require Bitcoin to grow approximately 100-fold.

Join me for my next post, in which I look at the spread of Cryptocurrencies in Europe and North America.

Pingback: Digital Money | The Swiss say yes to Bitcoin | Digital Money