Bank Sinar is a part of Bank Mandiri Group and as part of Indonesia’s move towards financial inclusion Bank Sinar worked with IFC and other partners to carry out a branchless banking pilot. Today we are joined from beautiful Bali by Pak Alit Asmara Jaya who shares his expert thoughts on banking the unbanked using mobile phones: where the challenges lie and what his hopes are for mobile banking in Indonesia in 2015 and beyond.

Pak Alit, thanks for your time today. We are greatly interested in understanding the branchless banking experience in Indonesia, and your experience in launching the branchless banking pilot. For context, could you please give us a bit of background about Bank Sinar?

Bank Sinar is currently majority owned by Bank Mandiri, a state owned enterprise. It has been in operation since 1970, having originated as a peoples’ credit bank. In 2004 we obtained a licence as a conventional bank and then in May 2008 the bank became a subsidiary of Bank Mandiri, the largest banking group in Indonesia.

The bank focuses on financing micro and small businesses and entrepreneurs. As of August 2014, our portfolio consists of over 80% of micro and small loans, with the rest being loans to medium enterprises.

The bank only operates in Bali for now, with 86 branches and 7 cash outlets. In terms of size, we have nearly USD 110 million in total assets and USD 78 million in total loans.

Our vision is to become the main challenger in financing micro and small business in Bali. Our mission is threefold: Firstly to develop the product and services as per market and customer needs, secondly to grow and develop Bank Sinar in a healthy and sustained manner and thirdly to support the professional growth of our employees.

Please could you describe the needs of the market and why you embarked on a mobile money/branchless banking pilot?

Indonesia has a population of 250 million, being the fifth most populous country in the world. However at present only 60 million people have bank accounts. The rest must depend on informal financial services. In Bali, an estimated 49% of working adults do not have bank accounts.

We embarked on the pilot with the following main purposes:

-

To renew our commitment to the micro segment and add to our customer base by tapping the unbanked segment

-

To differentiate our services in a highly competitive market

-

To serve our existing customers, as the additional services keep them loyal to Bank Sinar

-

Over the long term to increase our loan portfolio as savings accounts increase

As a bank, our core business is credit and the main goal of our Branchless Banking service is to provide basic savings and credit products.

Please describe the pilot itself. How many people were involved? What services were offered and how?

We started the project in March 2010 and launched in November 2012, but still without agents because the central bank was still in the process of formulating regulations for Branchless Banking.

At the beginning of June 2013, we started the pilot with agents based on the guidance from our Central Bank. We had 10 agents in 3 districts. Their core business is to run grocery stores and sell mobile phones and airtime top-up. The pilot ended in November 2013 as per guidance. Our project was in partnership with IFC and Axis was our Telco partner.

Our core team consisted of 10 people and was supported by other departments including branch, accounting, finance, operations, legal and compliance teams.

The services were of three major kinds:

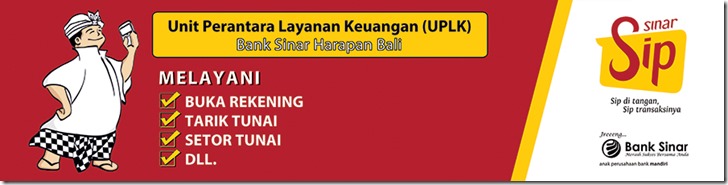

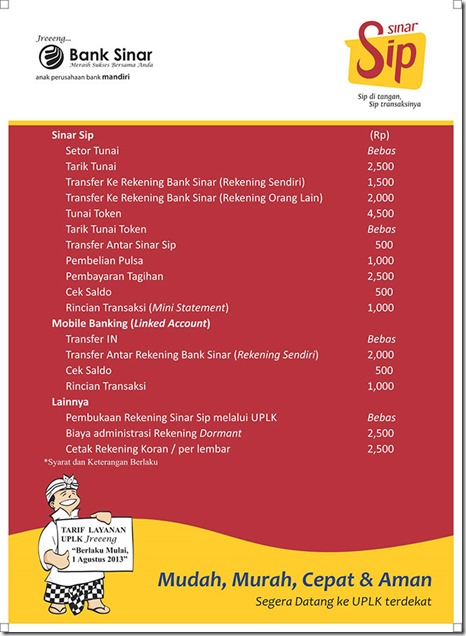

- Saving accounts, including opening accounts at the agents, deposits, withdrawals, balance inquiry and P2P money transfer

- Payments, including payment of bills, mobile top up and merchant payment

- Other services included linking the account to conventional savings accounts

We used USSD technology with the phone number as the account number. A PIN is required for accessing stored funds and carrying out transactions. Once an account is opened at an agent, it is directly active but with limited transactions until full KYC and verification has been completed by Bank Sinar. Transactions are completed in less than 45 seconds. Completion of every transaction is notified by SMS.

How did the pilot help, and what feedback did you receive?

We had a list of things to be tested and studied during our pilot. These included product positioning, speed of transaction, pricing/charging, fees paid to agents, agent incentives, customer education by agent, agent training and programs to register and activate customers.

Of the lessons learnt from the pilot, some key ones include the following:

- Consumers do have a need to save after working hours and on holidays

- The majority of customers who opened accounts at the agents were previously unbanked

- We need more Telcos to join the service

- Pricing was not an issue, in fact it was considered affordable

- The majority of the transactions consisted of deposits

- Agents who managed phone shops were able to more proactively sell products and they registered many more customers

- There was a strong demand for more billers to join the service

- Incentives for agents and customer worked well to increase transactions and accounts opened.

What are some of the challenges you faced in making such a service successful?

Getting this service to be successful requires attention to a number of different aspects. Some of the areas we have been looking at include the following:

- Telco coverage is still a challenge. Even the biggest Telco has some problems to cover the whole of Bali

- A lot of consumer education is required to convince people that use of the service will benefit them. Cash is still very much king

- We need to work with many more billers

- We require the ecosystem to include many more merchants

- It is hard to get agent commitment. Half of our registered agents were not able to make much progress in terms of registering accounts and encouraging transactions

- So far regulation only allowed Banks with category book IV to have the service and the product is only for e-money, not saving as Bank Sinar requires to do

- We would benefit from the involvement of the Central Bank and Government to help our campaign

- The Government must support through their policy to distribute subsidiary payments through mobile money

- Renewed long term commitment and budget from management

What are your hopes for 2015?

Our partnership with Bank Mandiri with the co-branding model using the e-money product of Mandiri will continue. We are in the process of preparing for it. The model will be the same with the name Sinar Sip but powered by Bank Mandiri. The service will be e-money phone-based service with the use of agents. Bank Mandiri has a licence to go for branchless banking based on e-money. So far this is allowed by regulation.

At present OJK (The new Financial Service Authority of Indonesia) is drafting branchless banking regulations based on basic savings account product and hopefully will release it this December. Bank Sinar looks forward to having our own branchless banking service. We can then reposition the Sinar Sip e-money into the Sinar Sip savings product. This would allow us to pursue our initial plan of outreach to the unbanked for increasing our savings customer base and micro loan portfolio.

I GN Alit Asmara Jaya is currently Managing Director of Bank Sinar, which is the micro-banking institution in Bali and a part of Bank Mandiri Group, the biggest banking group in Indonesia. Having worked in the industry for over 30 years, his wide experience includes operations, risk management, credit, export import, accounting and finance and branchless banking for the last 3 years. He is in charge of the Branchless Banking project of Bank Sinar.