Pressure mounts on Google, with the ICO (in concert with 27 data protection authorities across Europe) yesterday issuing their notice. How does this impact Google’s fundamental business model in payments, and what possible knock-on effects may we expect on new entrants with digital wallets based on similar models?

The Google wallet which hit the payments scene for in-store payments in the US in September 2011 seems to have made a timely move into money transfer via gmail across mobile and web before the basic premise of its early business model comes under pressure from European privacy action.

Early announcements in May 2011 sent a message to payment providers world-wide: reconsider your business models, or lose customers. At the time, a number of services had already dropped consumers fees, but the Google wallet went a step further, proposing to make payments free/cheaper for merchants as well, thanks to Google Offers and their dominant presence in the Search market.

At the time, the payments and money transfer markets were still relatively distinct. The personal payment market was dominated by MTOs such as Western Union, MoneyGram and Xoom and was heavily based on sender fees. On the other hand, ForEx providers worked largely on FX revenues. PayPal was the only major digital wallet that straddled payments and money transfer, offering individuals the ability to receive and send money. Google, through its August 2010 acquisition of virtual currency start-up Jambool suddenly threatened to shake up the market.

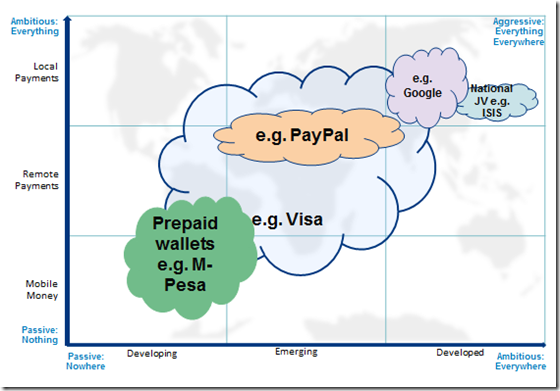

A number of new entrants were also readying their launches – Visa with its V.Me, ISIS with operators other than Google partner Sprint and ClearXChange (the American bank JV). The figure below maps the approach of some of the prominent wallets with respect to the markets in which they focussed and the kind of services they offered.

A key factor that had to be considered was their approach to Personal Data. As Meglena Kuneva, European Consumer Commissioner put it “Personal data is the new oil of the Internet and the new currency of the digital world”. In the framework we devised to predict the adoption of digital money, personal identity is one of the most critical building blocks. Confidence in who you are dealing with becomes ever more important as providers move from brick and mortar to online and mobile payment. Payment providers must legitimately source personal data so they know their customers well, as must banks and mobile operators. For operational purposes a ton of data on customers passes through them. A new school of thought rapidly gained ground – could this data be put to work to subsidise merchant and customer services?

Google held a particular advantage as Androids found their way into the hands of the majority of smartphone users, who also used Google services online. In a strategic move that was surprisingly quiet for Google, it announced the merger of Google Wallet and Google Checkout, and in March 2012 rewrote its privacy policy to unify customer profiles. Google Wallet 2.0 launched in September 2012, with an ID feature to further cement Google positioning in Personal Identity. Then in May 2013 Google made a bold entry into the personal payments market via money transfer through Gmail.

Since October 2012 we’ve seen mounting pressure on Google from the EU, as national data regulators gave Google four months to address legal flaws in their new approach to user data.

What is interesting is that Microsoft is a name that often comes up in connection with attacks on Google privacy policies. Having itself been slow to move in the payments area, the question is how will the recent EU concerns on privacy cause a rethink in fundamental business models for themselves and the host of new entrants across the various industries – Apple, Visa, MasterCard and Samsung to name a few.

Meanwhile while we analyse these developments world-wide, as an SME based in the UK, recently hailed as the world’s most developed online retail market, we are still waiting for the perfect solution to instantly accept small amounts internationally without paying dearly for it. Will the newly designed SEPA wallet hold the key for us?