Although mobiles and smartphones present an exciting new dimension for consumer payments, the Shift Thought Digital Money SAGE offers payments providers a panoramic view, so as to prepare for the eventual growth that is essential for building alternative payments services.

Alternative financial services are now being launched by organisations from multiple industries: banks and money transfer operators now have to contend with providers from diverse industries - mobile operators, digital wallet providers, smartphone providers and more. Each industry has unique advantages and handicaps depending on a number of factors within each market. These factors are complex and rapidly evolving, causing markets to develop along different lines, which can be challenging for global players. Organisations must be able to deal with the multiplicity of perspectives and business models, the rate of change and conflicting terminology in diverse regulatory environments. Although they may start with one service and a few channels, as they expand it is vital that customer experience is as seamless as possible.

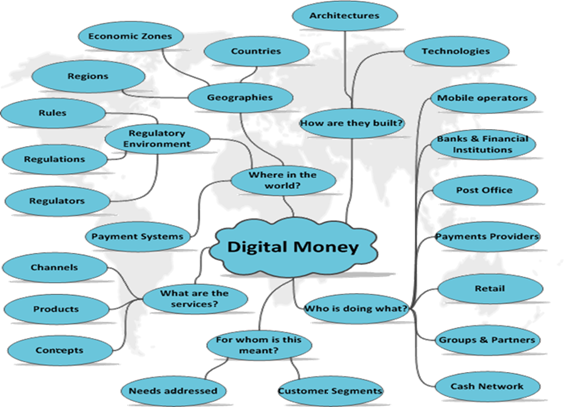

Organisations with ambitions in this ecosystem must navigate a vast body of constantly changing knowledge, to be able to ask the right questions at the right time and get the right answers. This requires exploration, best supported by a navigable portal, and analysis, best supported by comprehensive reports.

Shift Thought recently launched this portal to allow you to rapidly investigate country, region, service or player profiles of immediate importance to you. This unique solution is built using tools we have created to manage complexity. We maintain a constantly updated, perspective neutral and infinitely navigable knowledge base of what we term as “the digital money ecosystem”. This maps markets across 200+ countries and territories as well as corridors, detailing initiatives and players across multiple industries, along with their ownership and partnerships across services and geographies.

In launching alternative financial services today, we find organisations may need to partner or compete with other organisations depending on the jurisdiction and service. Through our experience of launching payment services as practitioners at some of the largest companies in each part of this ecosystem we identified a critical need for players to be able to understand perspectives from industries other than their own. We believe our Start Anywhere Go Everywhere (SAGE) approach and body of knowledge comprising over 15,000 pages of up-to-date, connected information offers a valuable resource, especially in conjunction with our Viewports, 200+ page reports on Digital Money in each market around the world.

As we pre-research knowledge, we have it ready for you when you need it. Our unique bite-sized, easy to digest and modular knowledge format is designed especially for C-level Executives with a view to offering an exciting new edge to their business development, market development and product development activity in each part of the world.

Contact: Charmaine Oak, Practice Lead – Digital Money, Shift Thought

coak@shiftthought.com , +44 (0) 754 0711 848, http://digitalmoney.shiftthought.com