As card payments grow in importance as the preferred way in which people pay, the good news is that the level of fraud using cards decreased by 5.8% since 2010. This post offers insights from the latest ECB fraud report alongside our analysis of the way people pay in the EU area, to help payment providers prioritise their support to payment instruments and consider the impact of fraud related issues in accepting payments.

The European Central Bank (ECB) issued their report on card fraud this month, indicating that the total level of fraud using cards issued within SEPA and acquired worldwide has decreased by 5.8% since 2010. However the figure is still substantial, amounting to €1.16 billion in 2011. The fraud-related share in the value of transactions fell from 0.040% in 2010 to 0.036% in 2011, its lowest level since 2007. As expected, the highest category continues to be CNP (card-not-present) fraud. ATM related fraud grew by 7.4% from 2010 to 2011.

Across the payments ecosystem there has been a move away from magnetic stripe cards towards EMV-chip technology. This EMV migration has been identified as one of the significant reasons for the reduction in card fraud. Fraud relating to transactions acquired at POS decreased by a massive 24.2%. As EMV migration is almost complete, fraudsters now turn to easier targets in non-EMV countries outside SEPA.

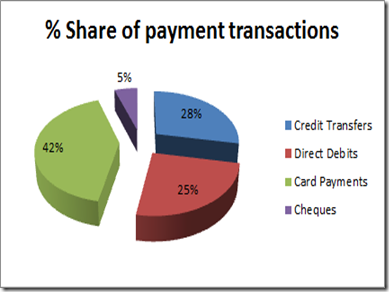

The chart shows the relative importance of the main payment instruments in the European Union (EU) area. People most prefer to pay by card, as cheque usage dwindles. (Note: This is based on the latest payment data from ECB as of 3rd July 2013).

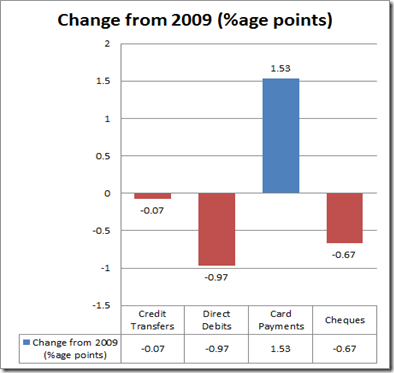

Since 2009 the way people pay in EU countries has dramatically changed. Our analysis of data as of July 2013 is presented below.

What is interesting is that in spite of new SEPA instruments being highly promoted, both credit transfers and direct debits transaction percentages have decreased. Perhaps this is a reflection of the increasing difficulty households in Europe face in balancing household budgets, causing them to choose to vet each bill individually. Another reason is the strong interest in making and accepting payments online and by mobile, where card payments so far reigns supreme.

Cross-border fraud within the SEPA area decreased from 28% to 24%. Although only 2% of transactions were acquired from outside SEPA, they accounted for 25% of all fraud.

Countries such as the UK that increased their use of 3-D Secure had a decrease in fraud. This has led the European Forum for the Security of Retail Payments to recommend that PSPs and payment schemes use strong customer authentication for card transactions conducted via the internet from February 2015.