Thanks very much to all of you who helped us to make this live webinar (our first!) a great success. With representation from over 20 countries, we received a number of questions and were not able to answer all of them in the time available. The post below addresses these and we hope you will find this useful. There is never just one point of view, and we would love to hear your comments and your unique ways of approaching the questions. If you missed it, catch the free replay here.

Q1: Is it advisable to partner with a Chinese company when seeking to enter this market?

A1: In general you may not have a choice in this. The question is with whom to partner and how to set it up so as to remain in control. An example is Yahoo China and Alipay. In Jack Ma’s speech at Stanford on May 14, 2013 he mentioned that Alipay digested Yahoo – they simply ate Yahoo and would not have been able to do their P-2-P advertisement platform without that.

This is a great question and to do full justice would probably need a session in itself. As a guideline, it depends on your industry, your ambitions and the roadmap you plan. Suffice it to say that I have seen careers made and broken largely due to the manner of handling this issue.

Q2: In your experience what is the biggest threat to successfully entering the Chinese market?

Timing and partnerships. Possibly in no other market could I say more strongly that a 360 degree understanding and a watching brief is critical. You cannot afford to walk into this blindfolded without opening yourself and your company to high risks, neither can you afford to do nothing. Understanding, anticipating and planning is highly important. It is equally important to understand Chinese culture and history as much as you deeply absorbing knowledge on the payments ecosystem and timeline.

Products and services must be made fit for the unique expectation of the market. For instance the clean streamlined experience of Amazon is not what is preferred – online shoppers want a busy, “happening” website. Similarly, there is a very different online-offline-CSR engagement in the consumer journey that one needs to learn.

There is a window of opportunity that must be well understood. We have found that players who act too soon have faced problems. On the other hand due to the need for domestic partners, it is advisable to act before all the “good partners” are taken.

Q3: How stable is the regulatory landscape in China? Is it prone to sudden changes?

In general it has taken many years so far for changes expected and talked about to actually happen. For instance I recall I first studied proposed regulations for licensing third party payment providers way back in 2006. They actually came out in 2010.

Similarly it is not uncommon to have a mass rollout, big commitments and plans in a specific direction only to see it overturned (example RF-SIM). For players who have built these products specifically for the Chinese market this can represent a serious setback.

Q4: Who are the companies to watch in this space?

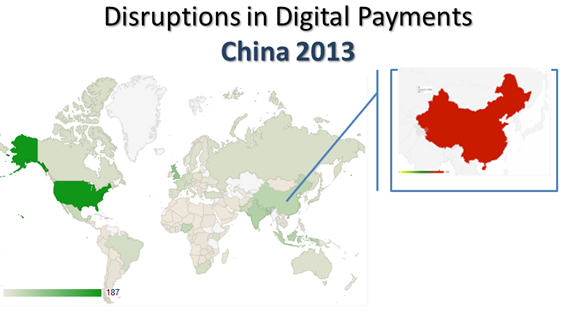

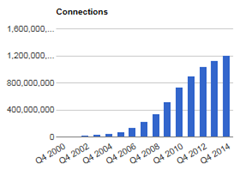

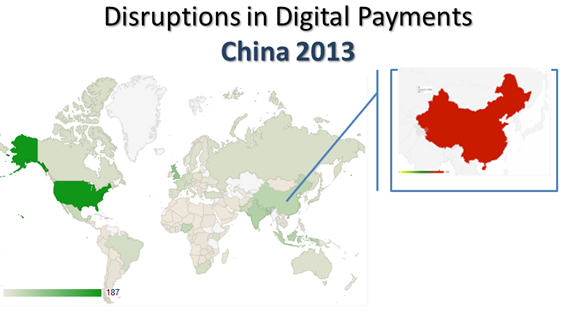

I touched on the main players in the China payments ecosystem during the webinar, so for those who have not heard it, it could be useful at this point to listen to the free replay here. Of course our 295 page “Digital Money in China 2013” viewport offers you the whole list of players, partnerships and initiatives with our best understanding of their importance and traction. There is so much happening in parallel and there is a high degree of cross-over. What we tend to do is to note how the payments gatekeepers are proceeding – CUP, CM, The big 4, the big 3 large PSPs and more.

Q5: What are the best partners to work with?

This depends on who you are and what is required by the regulatory environment. If you are to apply for a license there is a lead time involved.

A good example is Western Union’s recent thrust into China in partnership with ICBC and CUP.

Q6: How should we interpret Digital Payments in Hong Kong? How does the Chinese government and market incorporate the progress and regulation of that market?

The webinar only dealt with Mainland China. We plan a separate webinar that will address Hong Kong, China as also other countries in the region. In general the approach is One Country- Two Systems. This is why Hong Kong, China has a critical role to play in digital payments relating to Mainland China. More when we tackle this topic. Please register to our website (registration is free, takes seconds, only requires email address and provides you a much greater access to the overall content on our portal) so we can send on an invite to you once plans are in place.

Q7: Would you clarify your definitions for "digital wallet" and "digital money", thanks!

The Digital Money domain has been described by Shift Thought™ as a way to understand the ecosystem, products, services and infrastructure involved in the digitisation and transfer of value. We use this term to refer to a host of financial services that use innovative alternative channels, technologies, providers and payment instruments.

For a full definition and understanding of our approach please see Blog #3: What is digital money?

The Digital Wallet domain has been described by Shift Thought™ as a means of understanding the whole range of stored value products aimed at digitising value and enabling the owner to utilise it in a way that offers a superior experience as compared to traditional payment methods. Services utilise an account and stored value or e-money that may be utilised across various channels and services. This includes prepaid cards, vouchers, mobile wallets, e-wallets and more.

Q8: Is there any real digital money in China (I mean digital money that is not dependent on bank account or credit card)? All mobile payments solution are NOT based on digital money.

This is a good point. Please look at my response to Q7 on what is Digital Money earlier. We track an extended set of initiatives to do justice to our definition. However, specifically to answer yours, there is E-money that has been around for a while now. Prepaid cards, both open and close loop exist as discussed in our Webinar and covered in detail in our Viewport. More importantly, digital wallets and mobile wallets are very much in use.

You are right that all mobile payments are NOT based on e-money and a number of them require a connection to a bank account or card account. In the way we cover each of the 50 key initiatives on our portal, you’ll see our icon and descriptions that exactly show what payment instruments are supported for Senders and Receivers of each kind of service.

I hope this answers your question. Please feel free to reach out for a quick chat to discuss further. Also, this is not set in stone. We found an absence of accurate definitions in the marketplace and in those cases provided our own. Where possible we comply with the way in which CGAP, GSMA, Mobey Forum, NFC Forum and other key bodies and thought leaders already use these terms.

Q9: After utilising your China 2013 viewport, I also obtained your comprehensive Indonesia 2013 report. I noticed how in each country, both APAC members have approached and regulated differently - How would Shift Thought help a potential customer navigate these different markets?

That is a great question and thank you for the compliments on our viewports. Shift Thought is fortunate to have compared 19 different APAC countries in terms of regulatory approach as well as the predictor framework we use to project the growth of each of the 32 services we class as Digital Money.

We maintain a highly comprehensive knowledge base of regulations that impact on all these services, and understand how they may apply from each perspective. This, along with our deep understanding of player competencies puts us in a great place when we consult with large mobile operator, banking and money transfer groups in search of the right partners.

We’ll talk more on this in the Indonesia webinar. If you pop me an email on which countries you want to know about first I’ll consider this as we prioritise the webinars scheduled.

Q10: Charmaine - do you see an opportunity for mobile point-of-sale devices targeting Merchants in China much the same way that Square has addressed small Merchant needs in the United States?

Absolutely, and as is always the case in China, one of these providers currently cutting their teeth in the highest populated country in the world could well become a challenger to the Square, iZettle and huge number of mPOS providers currently starting of from the East. But it’s not just China. We’ve seen very interesting and innovative approaches elsewhere in APAC. This blog is getting too large, maybe a separate post later?

Q11: Sub Saharan Africa population is forecasted to reach China's in 20 years. What similarities if any do you see between these 2 markets and what learnings can Africa derive from China now to foster further successes in the contribution of digital money to more financial inclusion of unbanked populations.

Wow, this is a biggie. Thanks for this great question and sincere apologies that I can’t do justice to all of this today. However, I put it the other way, what can China learn from Africa including sub-Saharan Africa? – That is the real question. As the access that people have differs, I’d like to do fuller justice to this in a later post.

Q12: Hi - how pervasive are contactless payments in PRC? Thank you

For all the years I’ve worked with China there has always been something planned – most were trials, pilots. The real progress is in terms of installation of POS that supports contactless payments and cards. Once that is in place and China has elected to support the NFC standard, the people who currently use smart cards for travel all across China could very quickly change their behaviour to use of a mobile device instead. So to answer your question, contactless payments by card are already surprisingly pervasive!

I hope you have found this post useful. Again, this is just my perspective and I would love to hear from you as that is when the learning process really gets enriched. Thanks for the wonderful outpouring of support to me and thanks for being a valued member of our little fledgling Shift Thought community. Together we can make things better.