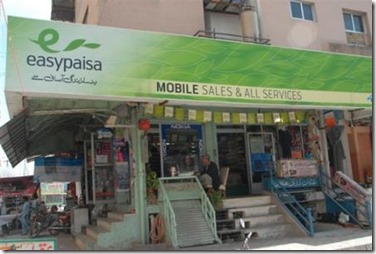

Easypaisa from Telenor Pakistan and Tameer Microfinance Bank has now woven 50,000 small stores into a brand new fabric of financial services that help move Pakistan from a cash based economy towards a position where the mainstream population can avail of a range of financial services that better their lives.

Easypaisa, a pioneer of branchless banking (BB) in Pakistan, today plays a key role in offering services through which customers can make payments in an assisted model as well as from digital wallets linked to their mobile phones.

Easypaisa, a pioneer of branchless banking (BB) in Pakistan, today plays a key role in offering services through which customers can make payments in an assisted model as well as from digital wallets linked to their mobile phones.

Today I have the privilege to speak to Omar Moeen Malik, Head of Strategy & Projects at Easypaisa. Omar shares about his 5-year journey, some of the key strategic decisions Easypaisa took along the way and what excites him about the future.

Omar, thanks very much for your time today. Could you start by telling us a bit about yourself and your role

As Head of Strategy and Projects for Easypaisa, I am responsible for developing and driving the strategy for Easypaisa. I head the key strategic projects as well as the product development for Easypaisa and I am responsible for developing our mobile money financial ecosystem in Pakistan through strategic partnerships. I was part of the core team that first conceived and implemented the project in 2008.

I designed and deployed the OTC and e-Wallet businesses back in 2009, launching the first mobile money service in Pakistan, and was involved in multiple functional areas over the years. I’ve played an important role in developing and managing the distribution channels for Easypaisa and have a key responsibility of interacting with the Telco and Banking Regulators on the Regulations for Branchless Banking (BB).

Congratulations on celebrating 5 years of Easypaisa last month. Could you please share a bit about the early days of the service

Back in 2008 we were captivated by the possibilities of bringing financial services to over 100 million adults in Pakistan, of which just 15 million were banked, but an estimated 70 million were mobile phone users. Inspired by success stories from Kenya and the Philippines we knew that as telcos we had the dual advantage of accessible technology and a vast distribution network across the country. The last 5 years has been a journey to leverage this to offer a full range of services, while working with our partner Tameer Microfinance Bank and our regulators to create enabling regulations to make this possible.

Once Branchless Banking Regulations were issued by the State Bank of Pakistan (SBP) in March 2008, we were the first in the market, with Easypaisa launched in October 2009. We achieved this through our strategic partnership and investment in Tameer Microfinance Bank Ltd (TMFB), the first recipient of the Branchless Banking license, so as to offer services under the bank-led model.

Today as the leader in BB with 57% of the volume of transactions, we serve 7 million customers across Pakistan on a monthly basis – they walk in to a shop to pay bills, and send money or receive money. These services are not limited to Telenor subscribers, but any person in the country can avail these OTC services. However, this is still a small number compared to the potential - there is a lot of work ahead of us still!

What kind of work do you see ahead of you?

The big piece is our on-going struggle with our largest competitor – Cash. Moving toward non-cash payments requires the development of entire ecosystems, and while we have a key role to play some of the work we’re doing is opening up big potential for our partners.

Then there is the OTC/ mobile wallet issue. How do we move from transactions to customers, and how do we get customers to keep money digital?

So why did you choose to go with OTC first, and how has that worked out?

We launched Easypaisa as an over-the-counter (OTC) service, whereby all transactions were agent-assisted and no registration was required.

We did this for 3 main reasons:

Firstly, this model made it possible to serve all mobile phone subscribers instead of only Telenor Pakistan customers, moving the needle on potential market size from 21 million to 110 million adults.

Secondly, for the agents, the cash in-cash out (CICO) business could just not be enough to establish branchless banking as a serious investment. OTC services, with their pricing model allowed for generous commissions to agents, compelling them to invest in Branchless Banking. Even if we had a wallet model we would need a CICO system anyway, and had to set up agents for this all over the country.

Thirdly, we believed in laddering the services for our customers. We started with OTC because OTC services entail the least behavior change. Customers were already used to walking into a Bank branch to pay their Utility Bills. All we asked them to do was to walk into an agent location. Customers would never have been able to do all these services on their own from a wallet. The low levels of literacy and use of technology meant customers prefer to have someone else carry out the operation for them.

I believe we were probably one of the first in the world to launch this assisted-model method for branchless banking. Although we only proposed to start this way and expected to soon move customers to the use of a mobile wallet, this shift has proved harder than we expected.

Please describe how you leverage your top-up network of a quarter of a million to build your agent network that grew from 2,500 to 50,000 agents today

The key thing was to give the agents sufficient business and provide our customers with an incentive to use the money from their mobile wallets rather than withdrawing and spending in cash.

The key thing was to give the agents sufficient business and provide our customers with an incentive to use the money from their mobile wallets rather than withdrawing and spending in cash.

Over the last 5 years we’ve worked on many levels – to improve the customer experience and make it easy to use services from their mobile phones, but also to create the assisted model for bill payment, utility payment and services that people need to use for their daily lives.

As Easypaisa celebrates 5 years of touching the lives of millions of people in Pakistan, could you please give us some background on the services such as this, offered by Easypaisa today?

Today in addition to our walk-in customers, we have more than 3 million customers subscribed to Easypaisa Mobile Accounts. Nearly 400,000 transactions take place on Easypaisa each day and in 2013, Easypaisa moved 1% of Pakistan’s GDP.

This new network supplements the 11,000 bank branches and 6,000 existing ATMs that were all that customers had to serve them across the whole of Pakistan at the time of our launch. From walking in to stores just to top-up their phones, anyone in Pakistan with a valid Nadra CNIC can now send and receive money and enjoy a lot more services as well.

We chose services that would help customers easily move away from cash. In addition to a range of payments and insurance services we’ve added some unique new products.

So for instance, there is a lot of interest in holding savings in gold. We recently launched two unique products with ARY Digital, a popular Pakistani television network available in Pakistan, the Middle East, North America and Europe and a subsidiary of Dubai-based ARY Group. Now customers can deposit an amount of their choice into an ARY gold account.

Life insurance, government benefit disbursement and other key services are helping to make the lives of people more secure while also helping the government address concerns relating to money laundering and terrorist financing.

Omar, like millions of others around the world, I am deeply inspired by Malala, the youngest Nobel Laureate winner in the world. How do you see Digital Money initiatives furthering the cause of education?

This year Easypaisa worked with Sindh Education Reform Program (SERP) unit for educational stipend disbursements and we have a number of projects such as disbursements to 400k students and social payments to 1 million women through government social cash disbursement programs. We are also enabling about 50,000 retired Government pensioners collect their monthly pensions

Easypaisa is one of the few mobile money services that support international remittances into wallets. What’s your experience with this? Does this drive the take up of wallets? Do people like it?

International remittances for Pakistan are considered the backbone of the economy. Yearly an estimated $20b comes in from large diaspora in Middle East, Europe and America. SBP estimates an equal amount could be moving informally that would mean a total market of $40 billion per year.

Initially we enabled our agent network to cash out remittances. However the value cashed out tended to be almost as much as their investment in provisions in their entire shop. We now find it a better model to ask customers to open a mobile wallet first. Today customers can withdraw this money directly to their wallets, making it safer and more convenient.

However in order to make this service really useful we need to have regulations appropriate to branchless banking, as these are not yet in place.

Omar, what do you find most exciting in terms of new services going forward into 2015?

With the platforms and network we now have in place, as well as the entire ecosystem getting established across Pakistan, I see literally billions of services that could take off. I am most excited about the immediate potential from online payments, retail Payments and merchant payments.

Paying for goods and services online has huge potential as more customers start to expect this service. Similarly we’re introducing ways to pay at the store through a customer experience that is actually the simplest of all services and we expect this to vastly help in the uptake and use of our mobile wallets.

Could you please share a bit about the huge potential of merchant payments in Pakistan and the project you recently launched for supply chain management?

We’ve recently launched a very successful initiative to streamline the supply chain for FMCGs and their distributors, leveraging our Easypaisa merchant network. This has worked out very well and is one of the transformational services that will further develop over 2015.

Starting with a paper-based system for order management, inventory and payments we’ve been able to create ways for our agents, who are also small stores, to order from and pay their distributors. This reduces wastage and risk for distributors while also helping our agents – a clear Win Win that we hope we can now replicate with our merchants in Pakistan.

Omar, speaking to you today has sent tingles down my spine. I am captivated by the vast transformational potential of what you have done and what you plan to do going forward. Thanks for so generously sharing your experiences and I wish you and the entire Easypaisa team the very best for achieving your ambitious goals.

|

Omar Moeen Malik, Head of Strategy & Projects, Easypaisa Prior to his 5 years of experience in Mobile Financial Services, Omar headed the GSM Value Added Services Products unit at Telenor. He has also worked with Teradata and has experience in Advanced Analytics with Data Warehouses for mobile operators and banks in the MEA region. A graduate of the University of Texas at Austin, Omar also has 3 years of experience in working as a Software Engineer with different organizations in the States including IBM. He also holds a MBA degree from the LUMS, Pakistan. |

Email contact@shiftthought.com for details

Part of the Global Interview Series by Charmaine Oak

Author of The Digital Money Game, co-author Virtual Currencies – From Secrecy to Safety

http://www.linkedin.com/in/charmaineoak

Join me on Twitter @ShiftThoughtDM and The Digital Money Group on LinkedIn