For the Philippines, remittances is a game-changer, showing healthy growth over the last 5 years and a highly competitive set of services from players across a wide range of industries. Philippines became the first country to introduce mobile money in 2000 and is a pioneering example for many different digital money services today. It is therefore highly instructive to hear from the experiences of Smart (PLDT), the largest mobile network operator in Philippines, and one of the very first to launch Smart Money as a mobile operator-based solution.

Today I am delighted to share with you some brilliant examples that use the concepts of digital money to unlock revenue streams.

Today I am delighted to share with you some brilliant examples that use the concepts of digital money to unlock revenue streams.

I have with me Lito Villanueva, Vice President and Head, e-Money Innovation, Digital Ecosystem Build & Global Engagements at Smart Communications, Inc. Lito shares how 14 years down the line, SMART is launching innovative services to create new revenue streams.

Mobile Operators in Financial Services

Financial services were once seen as a certain business model for new revenue streams for mobile operators. However this has proved to be harder than expected. This year Host Card Emulation (HCE) has sharply focussed on the fact that mobile operators are no longer the sole gate keepers to Mobile Payment NFC revenues. The GSMA has this year promoted Interoperability initiatives that hold a promise of better mobile money adoption, but this is not an easy solution as mobile operators do need to make the business model work through better churn reduction.

The Filipino Context

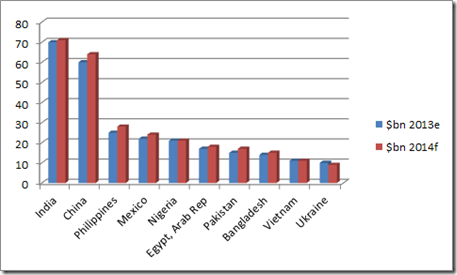

Although 12th in terms of population, The Republic of the Philippines is the third largest receiver of remittances in the world, with $22.7b for 2013, forecasted to rise to $28 million in 2014. Remittances touched a new monthly high of $2.286 b in Nov 2013, 7.5% higher than previous year due to Typhoon Haiyan (Yolanda), giving a boost to the new aid-oriented services.

SMART Money evolves into a “surround” experience

.jpeg?sfvrsn=0)

At Shift Thought we have for some years described how mobile phones are the magic sauce, but not the sole ingredient in a mobile operator’s toolkit for succeeding in financial services. It is important to create rich customer experiences across multiple channels and services, that I have termed a “surround” experience.

I think one of the markets in which we see good examples of a diverse set of services is in the Philippines. On a visit to the country to trial the service I found it delightfully simple to use my SMART Money card to pay for provisions at a department store as well as transfer money to other users.

I was interested to see the new Smart Postpaid app that was launched a few days ago as a one-stop portal to manage postpaid accounts. For use on Android and iOS devices, this makes it easy to access a range of features through one number *121#. It is products like this that can create consumer experiences that put the customer in charge.

Now this month SMART launches something revolutionary: A unique solution branded as LockByMobile. I was delighted to hear all about it from Lito.

My interview with Mr. Lito Villanueva follows. Enjoy!

It is great to have you here today Lito. Could we begin with a bit of background about yourself and the unique expertise you bring to the industry?

I currently lead initiatives at SMART to unlock the potential of e-money, extending beyond mobile money. Naturally we seek to leverage our unique capabilities with respect to mobile services.

Our mission is simple – to keep pioneering world-first solutions and unlock digital finance services to meet the unique needs of Filipinos including those in high growth and emerging markets.

Take for instance our world first anti-fraud and security solution. This month we are rolling out this solution to allow our customers in the Philippines to lock and unlock ANY ATM or credit card using its patented and proprietary LockByMobile.

We all know how important it is to control card security especially as online card-not-present use cases become more prevalent. Using our service people can finely tune what their card is allowed to do and lock down services themselves to prevent fraud.

You have been at SMART in the early days, back in 2007 – how has your strategy regarding financial services changed since then?

Well, for one thing, we did not have smartphones back then. Today over 10 million of our 70 million user base access our services via smartphones.

The Philippines is very much an Android market, and as the cost of handsets gets lowered we’re able to enhance the user experience of our services.

Yes, I’ve just been analysing implications of the launch of Android One, shortly planned for the Philippines. But what of the recent Apple Pay announcement?

Apple Pay is expected Q1 2015, but our NFC service will be launched ahead of that.

In November, we plan the first wave of a contactless payments rollout to our 2.5 million post-paid subscriber base. This is in partnership with Visa and Citi and will let people pay at Starbucks, McDonalds and other retail stores for face-to-face or via Paywave POS including our massive online merchant base such as Zalora, Easy Taxi, and a lot more in partnership with Rocket Internet for online commerce.

Remember that our parent company PLDT invested Euro333 Million into Rocket Internet representing approximately 10% equity share.

I understand you are also innovating with mobile loans services?

Yes, we offer salary loans via mobile to over 120,000 employees at 260 government agencies in Phase I.

This will extend in Phase II to include up to 20 million employees of private companies. They get access to what we believe is one of the lowest interest rates, at just 0.83%. This is touted to be the world’s first mobile-based paperless and fully electronic credit, savings and insurance in one.

What about money transfer and international remittance services?

At present domestic money transfer is big – it represents 70% of the volume, with international remittances accounting for 30%.

We’ve not so far made a big dent in this huge opportunity. One reason for this is the Philippines is a key market on which banks and money transfer operators in the key send corridors remain sharply focussed.

What are the differences that SMART Money has brought about in the Philippines?

Over 8 million of our 70 million subscribers use our services today. SMART is cited for being proactive and dynamically focussed on financial inclusion initiatives.

Three innovations launched by wireless services leader Smart Communications, Inc. (Smart) and its subsidiary Smart e-Money, Inc. (SMI) were recently ranked among the world’s best by Telecoms.com.

Smart Money Padala was nominated this year as Best Mobile Payment Solution. It serves the domestic and international money remittance requirements of Filipinos. With this service, Pinoys can transfer funds to tens of millions of Smart subscribers at the speed of a text message.

Smart Money Padala boasts of a large remittance network, with 95,000 international and 27,000 local remittance partners.

What are the biggest challenges faced?

Since our last conversation, we continue to be very focussed on customer education, and increasing the number of value added services.

Customer education is very important in order to lift the percentage of active subscribers from the current level of around 20%. It is a steep learning curve for customers to change the way they pay and we continue to create campaigns to address this.

What is your vision for 2015?

Our vision is to harness digital commerce to support every customer’s digital lifestyle. The time is right – the time is now. Things have come together to let us move from mobile phone payments to a much broader spectrum and support across an entire set of use cases.

No less than our chairman Mr Manuel V. Pangilinan is a firm believer of democratizing data by making free and available across our prepaid base of over 66 million. This is a strategy to shift our customers to the digital marketplace!

Thanks very much for sharing your thoughts with us Lito. We wish you the very best for 2015 and beyond!

Lito Villanueva is Vice President & Head for Payments Innovation, Digital Ecosystem & Global Engagements at Smart Communications, Inc.

Lito Villanueva is Vice President & Head for Payments Innovation, Digital Ecosystem & Global Engagements at Smart Communications, Inc.

Lito has unique expertise that crosses multiple segments and services from his work at SMART, IFC-World Bank and Visa. He is one of the few mobile money global practitioners to have a mix of experience in both banking and MNO sectors with a great deal of exposure in multi-market interventions and global best practices with established relationships with key stakeholders including international funding agencies.

Shift Thought has recently published “Digital Money in Philippines 2014”, a detailed study on the complex Philippines market. We have also created a unique research document focussing in depth on the remittances opportunity with respect to the Philippines.

Contact us today at contact@shiftthought.com to get access to this and other recent research on the Philippines and each of the emerging markets around the world. Each reports uses our proprietary Viewport format to create a highly interactive experience connected into our unique portal.

==