A new report from the World Bank shows that alternatives to cash are helping to drive down the cost of remittances around the world. The global average cost of sending $200 declined from 8% in Q4 2014 to 7.7% of the amount transferred in Q1 2015. But is this progress enough?

As development efforts have intensely focussed on driving down the cost of remittances (5% less over 5 years) it raises questions on why more has not been achieved.

Separately a report from World Bank that measures financial inclusion around the world, out this month, indicates that between 2011 and 2014, 700 million adults became account holders, with the number of unbanked dropping by 20% to 2 billion. While 2 billion adults without access to financial services is still hugely concerning, it seems that the 130 live mobile money services have achieved great things within domestic areas. People are increasingly gaining access to basic banking facilities thanks to the use of alternatives to bank branches, such as mobile-based accounts, agent networks, kiosks and other advances.

Domestic remittances (people sending money to other people within a nation) have thus benefited from the use of new technologies, in particular the services that leverage access to mobile phones. While the ownership of fixed line phones remains poor in certain African countries, large numbers of population now have access to mobile phones.

In my interviews with experts who are launching innovative services around the world I understand a lot more needs to be done to make sure that it's not just every household that has access to mobile phones. The key individual who can ensure household money is spent as it should, often the woman of the house, needs control of a mobile phone. This is likely to happen as government benefits and subsidies are routed directly to these individuals, often while providing free SIMs as is happening in Indonesia. This has the important side-effect of bringing down the cost of person-to-person money transfer.

Additional value-added services are being launched, to hopefully stop people from immediately withdrawing the money, and reducing the amount of cash in circulation. The new mobile money and branchless banking services have helped to bring down the cost of domestic remittances – for instance by 20% in Cameroon.

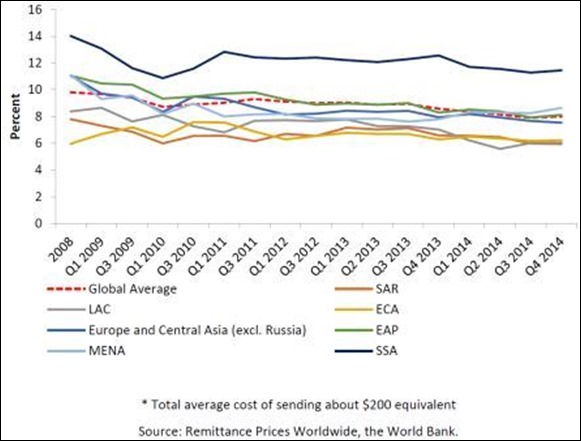

Yet the average cost of remittances still exceeds 8% in East Asia, the Pacific and MENA. In Sub-Saharan Africa, the home of mobile money, costs of sending money across borders remains the highest. Sending money from South Africa to Zambia, Malawi, Botswana and Mozambique are the highest in the region. With the global average cost for sending money standing at 8% in Q4 2014, it is substantially higher at an estimated 12% in Sub-Saharan Africa (SSA).

In the Figure above, courtesy of the World Bank Migration and Development Brief for April, we see just how much higher SSA costs are, and the lift in MENA costs. What strikes me is the sharp decline in cost of SSA transfers over 2009 was arrested in Q2 2010, and sharply rose then. We do not see a similar decline in spite of many new entrants and launches of services by global technology companies, card networks, mobile operators, handset manufacturers, retailers and others – indeed the list of industries alone is endless, leave alone individual providers.

Although there are more international migrants than ever before, with an expected 250 million in 2015, flows to developing countries are expected to slow down to 0.9% growth in 2015, increasing only from $436b in 2014 to $440b in 2015. Global remittance estimated at $583b in 2014 could rise to $586b in 2015, with recovery expected over 2016 to bring the figure to $636b in 2017.

Factors that are affecting these flows include uneven recovery in developed countries, lower oil prices and the Russian problem, tighter immigration controls and conflicts that are driving forced migration.

With an expected slowdown in the remittances market in 2015, it is vitally important that causal factors that stand in the way of better cross-border remittance services be better addressed. These include a number of factors that are well-understood (compliance, regulatory, exclusivity, interoperability) but others that are not yet under discussion, and may prove more critical.

What is your view on this? What has helped in the progress towards cheaper and more accessible cross-border remittances, and what has hindered? With technologies now well-understood, what needs to happen to put people more in control, not just for sending money home, but also for gaining other forms of livelihood in the vibrant, rapidly evolving global digital economy?