When I heard that Wanelo claims to have over 6 million users since it launched 2 years ago, I just had to experience the “want-need-love” they talk of, first hand.

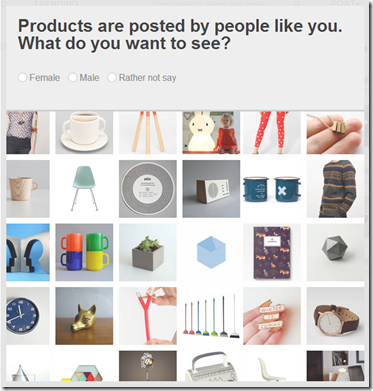

I found it easy to register on to the “fun site” which takes control and literally drives you through the registration process. It’s a whole new world where people follow companies, and the theory was I could check out what “people like me” are buying right now. Perhaps it’s because I am not in their classic target group, or may be I like to feel I am the one in control when I shop – either way, I left when asked which companies I wanted to follow.

Wanelo seeks to create a social way for people to find products and has reportedly excited the interest of investors and venture capitalists when the deal closed in February 2013. Their mobile app has been in the “Top 30 Free App” list. Urban Outfitters, Free People and a number of other retailers are reportedly clamouring for a piece of the pie.

It is part of the rapidly growing “Social commerce” category – you can check out some stats at f-commerce statistics roundup: Facebook commerce by the numbers.

The stats for the future got me wondering as to how some of the other cool digital money initiatives that impressed me some years ago are now doing. One that I recall from down-under was Visa’s payclick that seemed to have a strong social foundation for the younger generation. How might they have moved forward over the last 2 years? The picture below shows the site I recall visiting back when they launched in 2010 positioned as a competitor for PayPal in micropayments.

Payments could be made from the stored value on a payer's payclick account, or from a linked credit or debit card. Unfortunately it was hard to investigate further on this - Payclick shut it’s doors on March 2013.

If we’re going to derive some learning from the past, we probably need a “Digital Money History Museum”. What do you think?