Can India step up action on TBML? Considering the crying need for India to profitably export to support the needs of her vast population, cleaning up this area could be a huge win but involves a fine balancing act.

The Reserve Bank of India (RBI) has just been notified by the Directorate of Revenue Intelligence (DRI) of a high incidence of Trade-based money laundering (TBML) being used by Indians to get remittances into accounts in Hong Kong.

With the change of government in India, I hope we will hear more about this shortly and so thought it worth reflecting a little on TBML and where it fits within overall Money laundering (ML) scenarios.

TBML is defined by FATF as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins. While a lot of attention was on use of the financial system and cash movement, TBML received little attention until in 2006 FATF announced results of their Trade Based Money Laundering study.

They found that global trade in goods and services exceeded US $11 trillion a year. This offers fertile ground for tax evasion. By over or under-invoicing imports and exports, companies and their affiliates in low-tax and high-tax jurisdictions use tailored transfer prices to shift company profits and thus reduce worldwide tax payments. Some of this also represents capital flight, where currency restrictions are circumvented by pricing of imports and exports.

However while these two practices may involve legitimate funds, TBML is even more concerning, as it involves proceeds of crime.

It took 6 years more for the Asia/Pacific Group on Money Laundering (APG) to bring out their report, that investigated why so few cases of TBML were being detected in spite of expectedly serious incidence in the region.

Most customs agencies inspect less than 5% of cargo shipments entering or leaving their jurisdictions. Further, they tend to monitor exports less than imports. Consequently under-invoicing exports is a classic TBML ploy. What DRI would have detected would include cases of Indian exporters shipping a higher value of goods and services, with part payment received in India, and the balance deposited into a bank account, in this case in Hong Kong.

Money-laundering (ML) is typically carried out in three stages. Firstly, in the Placement stage, ‘dirty’ cash is placed into the financial system. Multiple smurfs (individuals or businesses) are used to repay loans, manage gambling scenarios, smuggle currency and blend funds into legitimate business.

Secondly, in the Layering stage, an attempt is made to move funds electronically, often between countries, in an attempt to obscure the source and links to the original misdeeds that are associated with the funds.

Thirdly, in the Integration stage the criminal receives possession of the funds from apparently legitimate sources. This could be done by buying property, cars, paintings and other high-valued items.

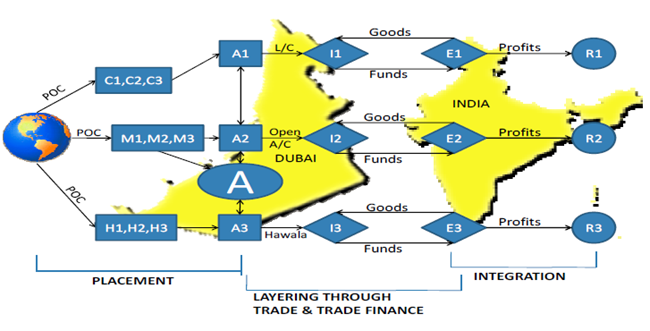

The cases that were highlighted in the FATF and APG surveys illustrate how placement, layering and integration take place through TBML. Case 7, a particularly complex one provided by India involved multiple ways in which trade was misused, with Dubai-based Indian national “A” laundering funds for drug cartels in Asia and South America.

FIGURE: A Case Study provided by India in the 2012 APG Report illustrates a complex case of TBML

Mr A established companies such as A1, A2 and A3 spread across Europe, Asia, Africa and USA. In Dubai Letters of Credit (LCs) were opened by these companies for importers such as I1, I2 and I3 in Dubai. Beneficiaries of the LCs were exporters such as E1, E2 and E3. By creating LCs for amounts much higher than the value of the goods, drug money lying with A was remitted to India. All that remained then was to integrate the funds – Exporters E1, E2 and E3 kept the price of the goods and transferred the surplus to R1, R2 and R3, family members of A in different parts of the world.

This case study helps in visualising the kinds of cases DRI must have highlighted to RBI. Considering the crying need for India to profitably export to support the needs of her vast population, cleaning up this area could be a huge win but involves a fine balancing act. Export has already been a highly controlled area for more years than I can remember. This already dissuades genuine small exporters. So I believe this is likely to be more a case of appropriate action than awareness. I look forward to more on this announcement, sooner rather than later.