Will Bangladesh, a pioneer of microfinance, be able to make a success of mobile financial services?

As part of their vision of Digital Bangladesh, they are engaged in rolling out services to the unbanked segment. This is part of a larger move towards Digital Money, with the Digital Money SAGE registering over 33 Digital Money initiatives, from over 46 players across a wide range of industries. Interestingly, these are not just local players. In September last year PayPal entered the country, on the initiative of freelancers who wanted a way to accept payments from people around the world.

As in case of Pakistan and India, Bangladesh has also adopted a bank-based model. This is unlike Kenya and a number of African countries. From a late start, Bangladesh has managed to pull forward considerably, with a decent traction of 1.3 million branchless banking accounts so far.

In a previous post I shared some analysis on Branchless Banking in Pakistan. In this post I’ll discuss why what I see happening in Bangladesh is important, what the relevance of this is, and what it could mean for the shape in which Digital Money is likely to grow in Asia Pacific, and indeed around the world.

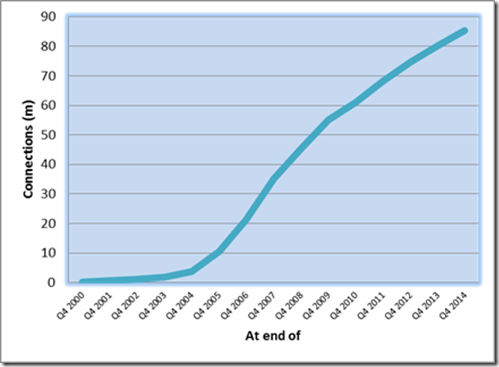

So why is all this happening? As we saw in case of Pakistan, there is a clear need and also a large market segment poised ready to utilise these services. With only 55 million of the 164m+ population banked, there are already over 89.5 million people with access to mobile phones. The figure below shows the manner in which mobile services have shot into use in the country.

However as Digital Money gets adopted in the country, it brings new challenges to the fore.

SIM Registration: As in other developing countries, Bangladesh has a high proportion of prepaid mobile users. This generally results in the problem of unregistered SIM cards.

Online frauds and scams: This is a challenge for customer adoption as well as profitability of the service. A number of the bank sites prominently display warnings and while this is necessary, it is likely to also put off customers from adequately utilising the services.

Collaboration and Competition: As players compete as well as collaborate there is a constant need to reach the delicate balance where regulation encourages the development of services whilst also protecting consumer interests.

In subsequent posts I expect to compare and contrast the developments we see in Pakistan and Bangladesh, and discuss what this might mean for the rest of the region.

Pingback: Digital Money | Malala's vision and Digital Money