Since the last update of the Branchless Banking regulations in Pakistan in June 2011, there has been an impressive growth in the number of BB agents so that they now overshadow other channels apart from POS. It seems Pakistan is poised to prove to the world that mobile operators and banks can work effectively together within a bank-based model to achieve the desired traction in banking the unbanked.

At Shift Thought we recently released two comprehensive 200+ page reports on Digital Money in Pakistan and Bangladesh. This blog shares some of our findings. This first post shares some thoughts on Pakistan. It will be followed by a post on Bangladesh and next a comparison of the development of mobile money in both countries.

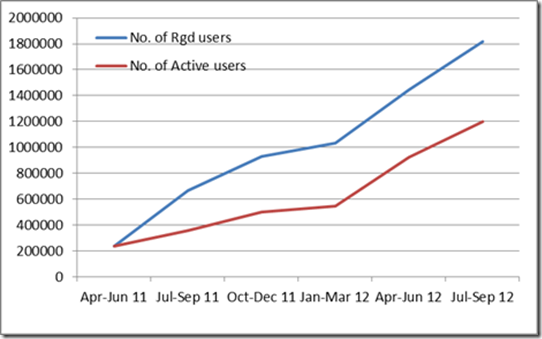

The figure below shows the extraordinary growth in the number of branchless banking users over the last quarters, based on data published by the State Bank of Pakistan (SBP). At last count these number 1.82 million, with 66% active.

Figure 1: Growth in the number of branchless banking users

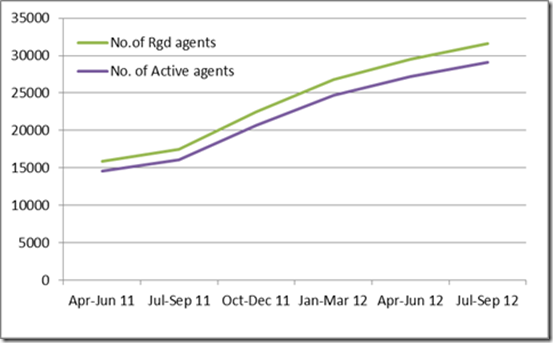

Although the dormancy of accounts remains an issue, this is something that the entire ecosystem is conscious about, and has been addressing. I believe we should see some innovative solutions shortly. Part of the solution involves the creation of a vibrant and trusted agent network that is pervasive and approachable to the customer segment. Having more than doubled the agent network within a year, Pakistan seems well on track to achieve this.

Figure 2: Growth in the number of agents

But why is this important, what’s the relevance of this, and is this a model that we should expect to see repeated elsewhere in Asia Pacific, and around the world?

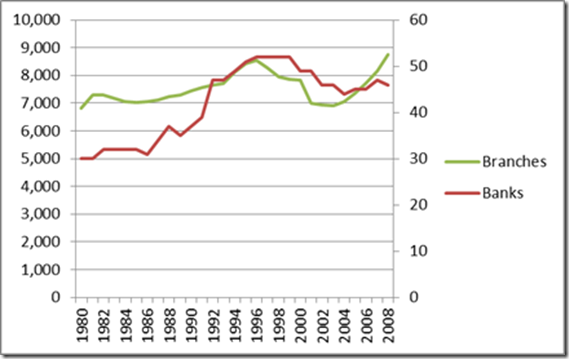

This is important because it is creating a safe and convenient way for the common person to transfer money, pay bills and even enjoy additional services such as insurance that they may not otherwise be able to afford. At Shift Thought what interests us most is the powerful enabler this becomes for the MSME (Micro and Small & Medium Enterprise) segment. With the number of banks flat-lining and the number of bank branches challenged by the economic conditions, all this was needed yesterday.

Figure 3: Trend in the number of banks and branches in Pakistan

It is relevant to other countries in Asia Pacific, Africa, Latin America and indeed even to the so-called “developed” nations around the world, where banks must have pretty special plans to counter their current challenging situation.

With only 2 services so far being the major contributors, there is already a buzz, so expect more as the rest of the players get their show on the road. The Shift thought Digital money SAGE registers over 31 Digital Money initiatives in a growth phase, launched by over 49 players from a wide range of industries. Contact us if you’d like to know more.

Pingback: Digital Money | Malala's vision and Digital Money