Shift Thought recently completed an analysis of Digital Money Initiatives around the world and I presented some of the findings at the Clarion MMMT APAC held in Singapore earlier this month.

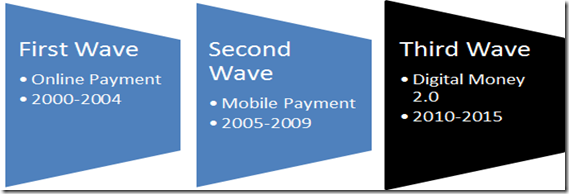

Digital Money first evolved as a way to pay for goods and services online. We still have PayPal from that era, but a number of initiatives either closed down or became focussed towards special segments, for example online gaming.

From 2005 to 2009 the main focus was mobile financial services. However my thesis is that since 2010 the move is back towards digital money, a trend which we observed in the launches we saw around the world .

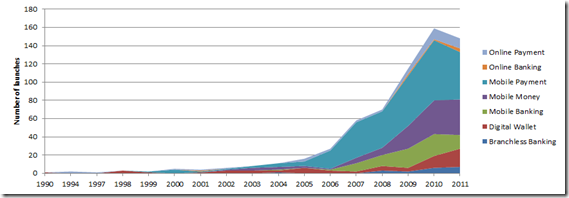

We surveyed more than 950 initiatives around the world, classifying them by segment, type of initiative, method of managing the value in the wallet, lead player and more. One of the charts we presented is reproduced below.

Interestingly, one can observe a dip in the number of initiatives in 2011. Did this indicate a slowing down of interest? Far from that, I believe this shows a coming together and the formation of larger ecosystems, JVs and other collaborations – in fact, a sign of maturity of the industry.

The digital money ecosystem is complex and rapidly evolving around the world. Many players now participate, collaborate and compete in this space. What players can do is determined by a number of factors including market characteristics, access and regulations.

At the Workshop I presented a framework to help make sense of what has happened in the last decade and to better prepare for opportunities and safeguard against risks to delegates brand and revenues.

Delegates were guided on a virtual ecosystem tour utilising the Digital Money SAGE, a unique knowledge technology. This provides context around digital money products and services, channels, technologies, players, vendors, regulations, geographies, corridors, agent networks and market segments to give you a solid foundation for making the most of the trends.

If you would like to know more about our study or enjoy a guided Ecosystem tour just drop us a line at contact@shiftthought.com.