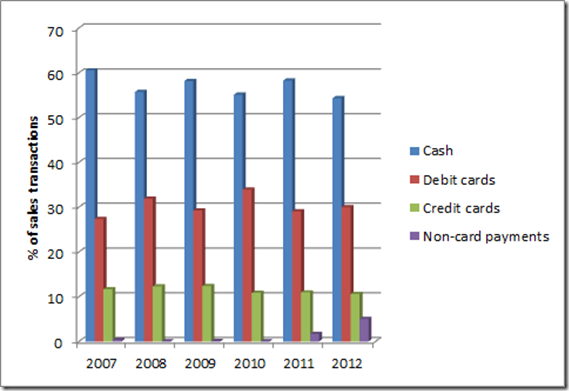

BRC’s Retail Cost of Payment Collection Survey for 2012 released in May 2013 indicates that PayPal and coupons have increased to a level that now requires separate reporting. This accounts to over 5% of transactions in 2012, as compared to 1.66% the previous year. There has been a steady change in the proportion of sales transactions by each payment method as shown in our graph based on BRC data.

Cash is still dominant at 54.4%, but is down by 6.7% compared to 2011. Debit card usage continues to increase, now standing at 48.2%. Of interest to us is the gain made by PayPal and coupons prompted by the adoption of online and self-service channels.

The growth of self-service checkouts has increased by 15 per cent with many existing retailers planning further growth within the next 12 months.

The online channel has even more impact on retail business and the way people pay. This has prompted a rethinking of tax structure as the British Retail Consortium is reportedly looking to put online retailers on par with brick & mortar shops that pay £7 billion per year.

Online commerce is causing policy rethinking as it takes off in many parts of the world. Neighbouring France is attempting to establish a new law that will prevent Amazon, from offering bundle discount offers or free delivery services for books in France. Meanwhile over in China and India the online market has been rising steeply creating a new wave of companies that are growing at rates not witnessed before – such as Alipay with 500 to 700 million registered users, even before it makes the expansion into US and elsewhere, promised by Jack Ma in his last speech as CEO, made at Stanford recently.

On the note of changes in the US Payments system, take a look at the recently released American Bankers Association policy makers guide “The Changing Face of the Payments System”. This too urges government policies in the wake of emerging payments trends, based on an advisory group representing banks in the US.