Blog 2

Dr. Neeraj Oak offers a definition of a cryptocurrency and looks at the many types and flavours of cryptocurrencies available today.

The growth of cryptocurrencies has been much too fast for definitions to keep pace with. That said, practically all cryptocurrencies can be said to share one key characteristic: decentralisation. But what is decentralisation, and how has it created such a potentially disruptive business model?

The traditional way of making non-cash payments is through a bank or financial institution (FI). These organisations provide a service as a central, trusted authority that guarantees the transaction in exchange for a fee.

Cryptocurrencies avoid using any central authority to route transactions by sending money directly between ‘wallets’. These wallets contain some quantity of the cryptocurrency, and possess a public and private keys. The public key can be thought of as an account number- a unique identifier that is visible to others and through which currency can be directed to you. The private key is more like a password, and is necessary to gain control over your wallet.

Transactions are made peer-to-peer, as wallets may transfer messages to one another over the internet instructing each other about the time and value of transactions. This cuts out the need for a central authority and the associated fees. On the other hand, transactions cannot be reversed in the decentralised model; it’s rather like paying in cash to a complete stranger.

Cryptocurrencies also share many similarities in the way they maintain a ledger of transactions, a vital requirement in keeping transactions secure. I’ll cover this in greater detail in a later post, but it’s important to note at this stage that it is vital for cryptocurrencies to make sure users can’t use the same money twice.

Beyond decentralisation, the number of types and flavours of cryptocurrencies is vast. Each cryptocurrency sets out its benefits in a subtly different way in order to stand out and attract new users.

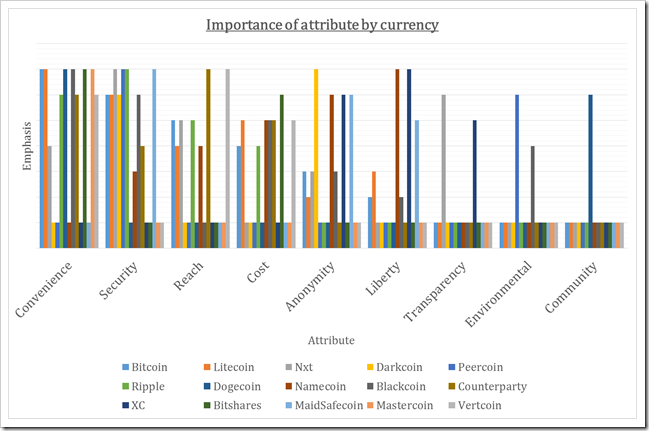

Looking at the advertising messages of the top 15 cryptocurrencies, I’ve created an index that shows the attributes that each try to emphasise to their prospective customers. This is shown in the column chart ‘Importance of attribute by currency’.

It’s clear that each cryptocurrency sees its appeal differently. Some, such as Peercoin and Blackcoin set out their product as being more environmentally friendly due to the lower computing power costs they require. Others such as Dogecoin appeal to users through a fun, community-focussed message. However, one needs to look at the trends in the advertising messages too.

The diagram ‘Weighted importance of attributes for top 15 cryptocurrencies’ was created by aggregating advertising messages of all of the top 15 cryptocurrencies. Surprisingly, cryptocurrencies seem most keen on appearing to be a convenient method of transferring money. It’s also clear that security is seen as a primary concern of prospective customers.

The ability to transfer money cheaply across long distances is also emphasised by most cryptocurrencies. This is an especially useful attribute for users who need to move money across borders, where government fees would otherwise apply.

Of late, cryptocurrencies have acquired a reputation for providing an anonymous service that circumvents financial and legal barriers. Few of the largest cryptocurrencies seem willing to emphasise this point further, as they perceive it as a barrier to their ambitions of moving into the mainstream of online payments. That said, some cryptocurrencies such as XC and Darkcoin heavily emphasise these attributes; it’s possible that this strategy will win over ‘ideological’ adopters of cryptocurrencies, who value a more libertarian way to pay.

Join me for my next post “Bitcoin: The coin that launched a thousand coins”, in which I look at the history of the world’s first and largest cryptocurrency.

![clip_image002[4] clip_image002[4]](http://digitalmoney.shiftthought.com/files/2014/06/clip_image0024_thumb1.png)

![clip_image004[4] clip_image004[4]](http://digitalmoney.shiftthought.com/files/2014/06/clip_image0044_thumb1.png)

![clip_image008[4] clip_image008[4]](http://digitalmoney.shiftthought.com/files/2014/06/clip_image0084_thumb2.png)