Blog 1

In this series of blogs, I will examine the global cryptocurrency economy, looking at its history and technical design, the many types of business models that have sprung up to make use of it and what the future might hold for this new and potentially disruptive concept. I will examine cryptocurrencies from several perspectives, including that of investors and banks, merchants, consumers and governments. Finally, I will consider the fundamental stability of cryptocurrencies, drawing on my background as a mathematician and complexity scientist.

Since 2009, there has been a radical new way of making payments. The creation of the first decentralised peer-to-peer payment system, Bitcoin, has led to the creation of a novel and booming set of payment services- known collectively as ‘cryptocurrencies’. These digital currencies are not created or backed by any government, nor does any one user have complete control over them. Could this become the chief way people pay for goods and services in the 21st century?

It’s clear that cryptocurrencies are an important and rising element in today’s digital economy. At the time of writing, the market capitalisation of the top 10 cryptocurrencies in the world was around $8.69 Billion and growing. But why have so many people invested their belief (and perhaps more importantly, their money) in digital currencies that have little-to-no intrinsic value and no state to back them up?

In the wake of the 2008 financial crisis, the trust in banks, financial institutions and governments has melted away amongst the populations of Europe and the USA; this is especially true amongst the younger, more tech-savvy demographic. It is from amongst this group of people that Bitcoin emerged. A central tenet of cryptocurrencies is to avoid using banks or established financial institutions to route money or accept payments. This cuts out the need for banks as third-party guarantors of transactions, and limits the ability of governments to interfere or regulate payments.

A side effect of removing third-party guarantors from payments is that the new payment method must be decentralised and trust-free. In such an environment, it is considerably easier to conceal one’s identity; indeed, declining to reveal personal information becomes the norm.

Inevitably, by providing a means of making payments secretly and without government interference cryptocurrencies have become popular with providers of illicit products and those who would rather operate under a cloak of anonymity.

However, there is a significant following of cryptocurrencies who appreciate secrecy as a response to a distrust of governments as a result of the spying allegations made by WikiLeaks and Edward Snowden. Many also feel that the internet should remain free of state regulation, and supporting cryptocurrencies might be a means of expressing this libertarian view.

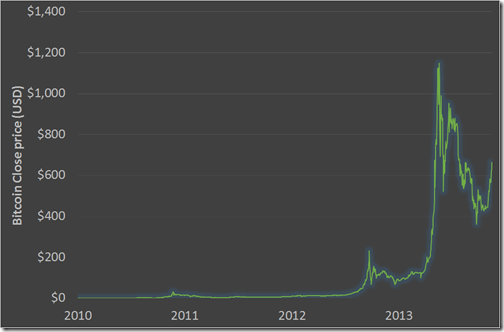

Finally, the growth of cryptocurrencies has been fuelled significantly by the activities of speculators, who can harness the volatile prices that cryptocurrencies often exhibit to make large profits.

While these groups of people have brought the cryptocurrency industry to its current state, they are unlikely to be able to create a viable and sustainable business model over the coming years without participation from the more mainstream economy. If cryptocurrencies are to become more than just a passing phase, the coming years must see a huge change in the types of users of these services.

Join me over the next few weeks as we look at the history of cryptocurrencies, their business models and technical structures and what the future might hold for this innovative but fragile industry.