Blog 4

Dr. Neeraj Oak explains the motivation behind the design features of Bitcoin, considering why Bitcoin is built the way it is. In this post, he concentrates on the concept of a decentralised cryptocurrency, and the implications it has for the users – and abusers - of Bitcoin.

There’s been a great many attempts to explain the underlying mechanism behind Bitcoin, from both a technical and user perspective. Some of these are rather excellent; I can hardly compete with such succinct summaries. What I will do instead in this post is to explain why the creators of Bitcoin made the choices they did when designing the payment mechanism we see today.

Let’s start with the defining feature of Bitcoin (and most other cryptocurrencies), decentralisation. Why is it important to decentralise the way people pay?

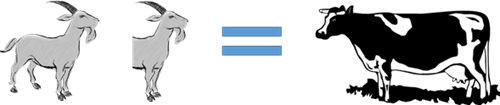

In essence, a payment is simply the exchange of one good for another. In the simplest form, this is just barter- Alice offers Bob one goat in exchange for one cow. But what happens if Bob thinks his cow is worth more than one goat? For Alice, having to pay one-and-a-half goats would be impractical… and messy. Here is where currency comes into the picture. Currency allows for a greater subdivision of value, and currency can be stored cheaply and exchanged for practically anything. But the value of the currency is just a useful fiction. For that fiction to achieve universal recognition, it requires people to choose to believe in it- and one shortcut to achieving this is to have the currency backed by a powerful entity such as a state or financial institution.

Another problem with barter is that, once complete, it cannot be easily reversed. In our earlier example, Alice would have to find Bob again and convince him to exchange the items again; this would take a significant amount of time and work. To counter this, banks and financial institutions (FIs) offer to be third parties in the transactions. They hold currency for a transaction ‘in escrow’ for a period to allow either party to change their minds. In return for this, they charge a fee, usually as a percentage of the transaction. In the times before fast person-to-person communications and digital money transfers, the bank or FI could also offer the service of connecting distant parties.

It should be noted that there is no fundamental reason that a transaction requires a third party to mediate it. Exchanging cash in person with a stranger is perfectly legal, if not always advisable. In a world where information can be transferred quickly and cheaply between individuals around the world, it was the view of the creators of Bitcoin that currency should be no different. Further, they saw the fees levied by third parties as unjustified, as the services they offer should be seen as optional extras instead of integral to the transaction.

Decentralisation cuts out the third party FI and allows the payee to quickly identify the recipient and transfer money, forgoing the escrow and transaction validation carried out by the banks. Escrow services are possible for cryptocurrencies too, and for now are predominantly free to use.

But choosing to decentralise the system has the side effect of removing any security checks made by the third party FI. Some of those checks are mandated by governments who are concerned about how funds are being used within their borders. Governments are therefore innately distrustful of decentralised systems, as it can be extremely difficult to verify that no laws are being broken, and even more difficult to track and punish criminals. Given a choice, a government would much rather deal with a financial institution as it saves a great deal of effort.

Join me for my next blog post in which I look at how the designers bypassed third-party financial institutions… by handing a list of every transaction ever made to anyone who asks for it.