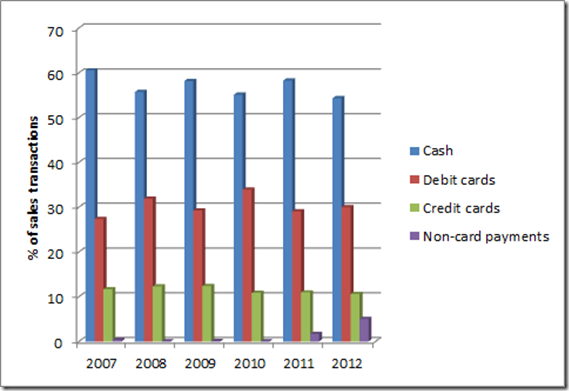

BRC’s Retail Cost of Payment Collection Survey for 2012 released in May 2013 indicates that PayPal and coupons have increased to a level that now requires separate reporting. This accounts to over 5% of transactions in 2012, as compared to 1.66% the previous year. There has been a steady change in the proportion of sales transactions by each payment method as shown in our graph based on BRC data.

Category Archives: Europe

Apple iCloud Keychain – Digital Money services take to the cloud

Soon after May 2011, when there were a flurry of digital wallet announcements, such as Google Wallet, V.Me, Amex Serve and more, Shift Thought provided analysis to show how these fitted into the trend that we predicted, and continue to rigorously track since then.

This is a move from a mobile-centric approach to a convergent, if not integrated set of offers that become a powerful foundation for a closer relationship with your customers.

In June 2013, the Apple iCloud Keychain serves to once again underline this trend. By hosting key details on the cloud and offering single access across a host of devices, payment services from Apple seem to be in the mould of one of the “personas” in the Digital Money SAGE framework that describes wallets of the future.

The Google Wallet has already moved forward on this path. By merging with the Google Checkout and later rebranding to a single service, Google has instantaneously opened the doors to a powerful way of engaging with 7 billion people around the world. This of course is the power of adopting a strategy that recognises Digital Money in all its guises.

Shift Thought will be running a workshop on Digital Money at the PayExpo 2013 on the 18th of June in London, UK. We intend to run through the timeline of Digital Money, with special case studies to underline the trends, risks, challenges and the level of competition.

We hope this will give you concise round-up on what is happening, and the new axis on which services differentiate themselves across the world today.

We look forward to seeing you there!

When the dust settles, what position will the Post have in the newly established Digital Money ecosystem?

This morning while reading about the Joy in Oxenhope, UK from the promise of a Post Office at the Co-op store, I was reminded of the critical importance of innovations in retail payments, not only to the unbanked and the under-banked in developing and emerging countries but to people in some of the most developed countries in the world such as Europe, the Americas and Australia. Oxenhope is not by far in the remotest region of the UK (See figure), and closing down of post offices is a regrettable and seemingly unavoidable trend that should be of concern world-wide.

![clip_image002[9] clip_image002[9]](http://digitalmoney.shiftthought.com/files/2013/06/clip_image0029_thumb.png) A large part of the long awaited services that are to be offered by the Post Office in Oxenhope involve money, including online banking, cash deposits, tax disc registration and withdrawals, pension transactions. Post offices offer an important outlet for Government services, such as cashing Green Giros and paying for fishing licences, as well as allowing customers to top up mobile phones, pay bills and pre-order foreign currency.

A large part of the long awaited services that are to be offered by the Post Office in Oxenhope involve money, including online banking, cash deposits, tax disc registration and withdrawals, pension transactions. Post offices offer an important outlet for Government services, such as cashing Green Giros and paying for fishing licences, as well as allowing customers to top up mobile phones, pay bills and pre-order foreign currency.

Around the world it is becoming increasingly costly to support brick-and-mortar branches, and post offices play a critical role in offering basic financial services. In sub-Saharan Africa over 80% of post offices are located outside the most populated cities – as 82.5% of populated live there.

The time is now for post offices to reinvent themselves and adopt a central role in the newly developing Digital Money ecosystem. In subsequent posts we’ll focus on some of the hero services around the world that are, maybe not at the foot of the mountain, but still somewhere near Base Camp 2.

Contactless payments with BarclayCard PayBand at BBST Festival, UK

This summer Barclays is promoting their PayBand contactless payment in the UK through a marketing campaign that directly targets segments that are most likely to appreciate the convenience, in the ambience of the British summer festivals. This wearable prepaid device is free and available even to consumers without Barclaycards, and it will not activate for transactions over £20.

PayBand made it’s debut at music festivals in the UK last year. It can be used to make contactless purchases of up to £20 at UK retailers accepting Mastercard PayPass contactless payments. The service neatly sidesteps issues regarding potential misuse, firstly in the manner of presentation (it may be a little obvious using a bright blue band to launder money), but also through limits - the maximum balance you can have is £200, and consumers are not able to load and spend more than £500 during the lifetime of a PayBand.

This summer it is being heavily promoted as a cool way to pay for food and drink at UK festivals at Barclaycard presents British Summer Time (BBST) in Hyde Park on 5-14 July 2013.

Considering all the firsts from Barclays: The first UK credit card on 29th June 1966, the first UK debit card in 1987, Pingit launched in February 2012 - it seems to me that Barclays is well placed to usher in this payment trend, right here in the UK. All the work put in through NFC trials since 2007, commercial roll-out of contactless cards in UK and more has prepared the stage for the bright blue band to earn its place as a favourite memory that people will look back to in years to come.

UK awareness of contactless payments has doubled as per the latest study, with over 53% having used their mobile to make a contactless payment purchase, compared to 47% last year.

What impact will Digital Money have on employment?

The chief executive of Barclays, suggested during investor meetings that Barclays aims to become a self-oriented company, allowing staff to focus on added value. Antony Jenkins envisages a future in which the bank employs as few as 100,000 people (current strength ~140,000).

While this is being positioned as blue-sky thinking rather than a statement of potential job cuts, it got me thinking about how the advent of Digital Money is likely to impact what is closest to our hearts at Shift Thought, namely the creation of jobs world-wide.