This is an interesting time in the development of the digital payments market in Poland. The leading banks are collaborating to launch mobile payment services that potentially bypass the card schemes, allowing consumers to pay directly from their bank accounts. As a follow on from our previous blog, Transforming the way people pay in Poland Charmaine Oak interviewed Tomasz Krajewski, Head of mCommerce at eLeader. SuperWallet claims to be the first wallet to combine mobile banking, mobile payments and mobile commerce services. Tomasz shares his thoughts on the Polish payments market, as well as other markets in which eLeader has been active.

CO: Tomasz, thanks for taking the time to share with us your thoughts on the development of mobile commerce, in Poland and elsewhere in the world. To start with, could you kindly give us a short introduction on the achievements of eLeader. In which markets do you now operate, and who are your main customers?

TT: eLeader is a leading mobile software company, with experience that dates back to the origins of the smartphone industry. Our services are used in over 70 countries worldwide and clients include Grupo Santander, Unicredit Group, mBank, Danske Bank, Raiffeisen, the National Bank of Kuwait and Orange/T-Mobile.

Our innovations have allowed us to achieve a number of awards and high ranks in industry reports, including a mention in the Top worldwide mobile banking vendors report (Juniper Research, 2012), Technology Fast 50 CE (Deloitte, 2008) and the Top technology companies in Europe (Red Herring, 2013).

CO: How has eLeader gained such a leadership position in Mobile Banking?

TT: You can say that going against the current is in eLeader’s DNA. We launched in 2000 with mobile solutions to support employees to work remotely, from outside the office. In those days in Lublin, where we are based, few people had even heard about smartphones, and many felt that this was a crazy idea. And perhaps so it was, but the product was a total success.

We started to invest into mobile banking in 2006 and that was the time when people were speaking about the brilliant future of WAP protocol, forgotten today. Back then, few had heard of smartphones. The iPhone and Android had not yet made a mark. Nokia had a dominant position in the market. At that time, we believed that native apps would be the future of mobility also in the banking industry.

Our first mobile banking platform was revealed in 2007 and it was based on native apps for 3 platforms: Symbian, BlackBerry and Pocket PC. As far as we can tell, ours could well have been a world first solution, with native apps individually designed for all the major OS platforms, accounting for over 95% of the smartphone market.

Raiffeisen Bank became our first customer in Poland. I remember meeting with the President of the bank. Instead of showing a slide deck, our CEO, Dobromir Piekarski, handed him a Nokia smartphone with our banking app – without any instructions. He played with the app in silence and just asked a simple question: How much? After a negotiation of just one minute they shook hands on it. The legend is that this could have been one of the fastest decisions in the banking industry, ever!

CO: What were some of the challenges you encountered on the way?

TT: The biggest challenge was our first implementation. As mentioned earlier, we started at a time when the mobile banking industry was in its infancy. There was a lack of best practices and useful benchmarks. We had to convince the clients to use our solution, without any projects in the portfolio, armed only with cold calling. Can you imagine what that was like?

We had to design a new concept of application interface, UX and security measures.

Most banks were generally skeptical about native apps at that time; many said that we are going in the wrong direction. Fortunately very soon the iPhone changed the whole industry and attitudes to mobile apps. Native apps went main-stream, and became the norm.

Another milestone was reached when we entered foreign markets. By that time we had something to show in our portfolio, but still needed to prove that an unknown Polish company was able to make great applications and that too without any branches in the client’s country.

CO: In what way is Innovation in mobile banking held back by compliance requirements?

TT: Did you know that when the financial crisis came to Poland none of the banks have announced bankruptcy?It seems that none of them have even been in danger of such a situation.

To some extent this is thanks to Polish banking supervision which is very strict in terms of control. However, on the other hand regulations are so far-reaching that they do not allow banks to overstep clearly defined and legally imposed limits. This extends also to the sphere of innovation. You can say that from the regulator point of view, banking is for banks, and deviations from this principle are not allowed.

For instance, take the most used mobile banking functionality – checking one’s bank account balance. Because this is considered disclosure under banking secrecy, bank should require that the user authenticates before gaining access to balance information. Some of banks will ask you to login. Other banks will show you only the percentage of funds left in your account. There is also a bank which lets users choose which of the options would suit them best. You may say this is not a big innovation, but it clearly shows that users want the simplest solutions possible.

Non-bank start-ups are not subject to banking regulations, which is undoubtedly their competitive advantage in the market.

CO: In what areas do you see mobile security improving over the next 3 years?

TT: The trend to watch is certainly biometrics. My voice will be my password to mobile banking. Gartner predicts 30% of organizations will use biometric authentication on mobile in 2016 so this is worth watching.

CO: What has caused the Polish market to develop more rapidly than some other European markets in recent years?

TT: Polish people don’t use checks, and we never did. When in the 90s Poland entered capitalism after the communist era, emerging banking industry implemented only the newest IT solutions, leap frogging the old payment systems. This is one of the reasons why today we lead in contactless payments globally, and can transfer money from one bank to another in just 30 seconds, thanks to the Elixir Express standard.

Contactless penetration in Poland is higher than anywhere else in Europe or the Americas. This is largely because Visa and MasterCard have invested to subsidize contactless readers, so as to transform Poland into a showcase market for contactless payments. We are at the forefront not just in penetration of cards with a contactless function (20 million, 57.7% of all cards on the market) but also in number of POS accepting contactless payments (in the fourth quarter of 2013 this was already 170 thousand, or 52.1% of all the devices on the market).

Other important favorable factors for Poland include the high mobile and internet penetration, the highly educated society and our continued economic growth. According to Person’s ranking our education is ranked 10th in the world and the last time we had a recession was at the beginning of the XXIII century.

CO: How does eLeader expect to continue to play a leadership role in Europe, and elsewhere?

TT: The year 2014 is critical for us, as it is the time for us to launch the new mobile solutions that we have developed through our focused Research & Development over the last few years.

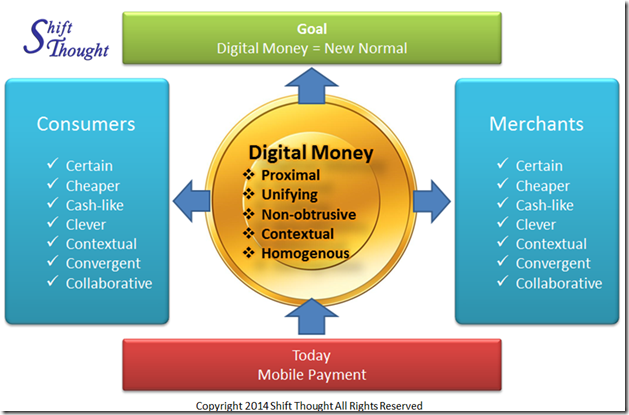

The product we are now introducing to the market is the SuperWallet. It is a combination of m-banking, m-commerce and m-payments. The biggest innovation of these is our embedded in-app commerce services. These services allow users to, for instance purchase public transport tickets, shop for groceries with home delivery, pay for cinema tickets, order taxis and pizzas or book flights.

Our aim is to transform mobile banking into the first choice financial app for smartphone users by supporting them to perform all their daily activities. Recent SAS studies point out that, above all, users perceive mobile wallets as a way to buy goods online, pay bills and check bank accounts. All of these and much more can be achieved by one SuperWallet app.

Together with an ecosystem of integrated merchants, the SuperWallet is offered as a white label solution for banks in a PaaS (Payments as a Service) model.

This has already been successfully deployed by the biggest Santander Group bank in the CEE region, Bank Zachodni WBK, and is gaining popularity among its users. Because the SuperWallet has very flexible architecture and a wide array of capabilities, we are greatly excited to see how it will be used by banks from outside the CEE region.

I believe that the SuperWallet is at the cusp of an emerging market trend. Solutions that are similar but limited to in-app purchases can be found in ICICI Bank and PrivatBank offers.

CO: Tomasz, thanks for your time today!

This has been incredibly informative, and provided us with interesting insights into the payments scene in Poland. Above all, what you have achieved at eLeader is most inspiring and I take this opportunity to wish you the best of success with your plans for the SuperWallet and beyond.

Tomasz Krajewski is Head of mCommerce/Superwallet at eLeader. He is responsible for development of SuperWallet, which claims to be the first wallet to combine mobile banking, mobile payments and mobile commerce services, thus adding value to mobile banking. The first SuperWallet was deployed in November 2013 in BZ WBK (the biggest bank of Santander Group in CEE). eLeader is one of the world's top mobile innovators in the smartphone business software market, used by global and national companies in over 70 countries worldwide.